There are way too many cryptocurrency exchanges available out there that help you with both investing and trading.

Among them, we are going to look at two names, Independent Reserve and Bybit.

Both these exchanges sit on the opposite side of each other. Hence, many traders are confused between Independent Reserve vs Bybit.

If you, too, have a similar confusion, then to clear your confusion, I have compared both crypto exchanges in various key areas below.

So you can opt for the right crypto exchange as per your needs.

Independent Reserve vs Bybit: At A Glance Comparison

Independent Reserve is one of the oldest cryptocurrency exchanges out there. It is an Australian-based cryptocurrency exchange founded back in 2013.

The exchange is known for offering a secure and regulated platform for individuals and businesses to buy/sell and trade various cryptocurrencies.

However, like many other crypto exchanges, Independent Reserve isn’t feature-rich or suitable for traders as the exchange is only meant for investing in crypto.

But the exchange makes your crypto investing journey super easy.

Bybit, on the other hand, is one of the best crypto derivatives exchanges. The exchange not only allows you to invest in crypto. But it offers you a suitable option for crypto trading.

The exchange was founded back in 2018, and it is based out of Singapore. With Bybit, you can trade in different crypto markets like spot, margin, crypto futures and options.

As well as, Bybit offers you tons of other features, like trading bot or copy trading. So you can both trade and invest in digital assets more effectively. You can also use Bybit’s referral code to sign-up to get welcome bonus.

Independent Reserve vs Bybit: Trading Markets, Products & Leverage Offered

Independent Reserve

- Spot Trading – Basic Buying/Selling of crypto tokens

Bybit

- Spot Trading

- Margin Trading (5x Leverage)

- USDT Perpetual Futures Contracts (up to 100x Leverage)

- USDC Perpetual Futures Contracts (up to 125x Leverage)

- Inverse Perpetual Futures Contracts (up to 100x Leverage)

- USDC Options

- Leveraged Tokens (2X Leverage)

- Copy Trading

Verdict: Bybit undoubtedly is the better choice in terms of product offerings and Leverage. Since you can use the exchange for both investing and crypto trading.

Independent Reserve vs Bybit: Supported Cryptocurrencies

Independent Reserve

When it comes to supported crypto tokens, Independent Reserve isn’t really impressive. As the exchange only offers you access to 30 crypto tokens.

But you can be assured that you are getting access to all the popular crypto tokens.

Some of the listed tokens are:

- XRP

- USDT

- BTC

- USDC

- ETH

- SOL

- LTC

Bybit

Bybit is a better choice in terms of supported crypto tokens. As the exchange supports more than 400+ crypto tokens and other trading pairs.

Also, the exchange is known for adding new crypto tokens from time to time and has a mix of both well-known and new tokens. Some of these listed tokens are:

- BTC

- ETH

- RNDR

- GMT

- SOL

- 1000PEPE

- XRP

Verdict: Bybit supports 400+ crypto tokens which make the exchange a clear winner. On the other side, with Independent Reserve, you are getting access to a limited number of tokens only.

Independent Reserve vs Bybit: Trading Fee & Deposit/Withdrawal Fee Compared

Whenever it comes to choosing a crypto exchange, trading fees have to be the deciding factor. Make sure to opt for an exchange with the lowest trading fees. And here is how both these exchange’s trading fee compares:

Independent Reserve Trading Fees

Independent Reserve charges you a flat trading fee. There is no maker or taker fee model. Instead, you are required to pay a flat fee whenever you buy or sell on the exchange.

In addition to that, you can also avail of heavy discounts on your trading fees by increasing your 30 days trading volume. And the maximum and minimum trading fees that the Independent Reserve charges are:

- Maximum Trading Fees: 0.50%

- Minimum Trading Fees: 0.02%

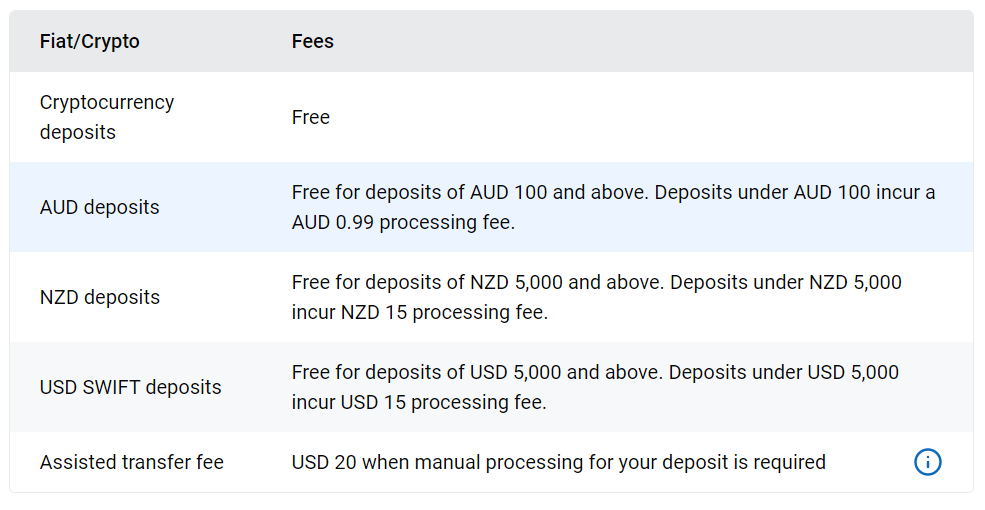

Independent Reserve Deposit & Withdrawal Fees

Talking about deposits on Independent Reserve, it offers you both free and paid options. For instance, if you are depositing crypto from another wallet or exchange, there are zero fees.

However, if you are depositing AUD, then you will enjoy free deposits of AUD 100 and above.

Under AUD 100, it will attract an AUD 0.99 processing fee. And the same applies to other fiat deposit options like NZD, USD SWIFT, or Assisted Transfer.

Talking about withdrawals, it charges you certain fees depending on your withdrawal method. For instance, AUD EFT withdrawals are completely free. But AUD PayID/NPP instant withdrawals incur AUD 1.50 fees.

The same applies to crypto withdrawals. The fee depends on what currency you are withdrawing and a few other factors.

Bybit Spot Trading Fee

Bybit has a straightforward fee structure following the maker-and-taker fee model.

It also has different tiers based on your 30 days trading volume, which allows you to avail additional discounts on your trading fee.

However, the regular trading fees that you will get charged are:

- Maker Fee: 0.10%

- Taker Fee: 0.10%

Bybit Futures Trading Fee

- Maker Fee: 0.06%

- Taker Fee: 0.01%

Bybit Deposits & Withdrawal Fees

Talking about Bybit deposits and withdrawal fees, there are no charges for crypto deposits.

However, for crypto withdrawals, you are required to pay certain charges which vary from one crypto token to another and other factors.

Similarly, when you are depositing/withdrawing crypto using payment options like debit/credit purchases, bank transfers, and others, it will incur a transaction fee.

Fortunately, Bybit also supports P2P trading. So you can use it for free fund deposits and withdrawals.

Verdict: Bybit is the ultimate winner. As the exchange has the lowest trading fees and offers you a good discount as you level up your trading tier.

Independent Reserve vs Bybit: Order Types

Independent Reserve

- Market

- Limit

Bybit

- Limit

- Market

- Conditional

Verdict: Bybit is the better choice. The exchange allows you to place both usual and advanced orders. Whereas Independent Reserve only executes your trades at the current market price or at a limit price.

Independent Reserve vs Bybit: KYC Requirements & KYC Limits

Independent Reserve

Independent Reserve is a well-regulated crypto exchange.

As a result, the exchange does require you to complete your KYC before you can start trading. Also, once you are done verifying your account, you will get unrestricted access to all the features.

Bybit

Bybit also made it mandatory to complete your identity verification before you can start trading on the exchange. However, unlike Independent Reserve, Bybit does have different levels of KYC with different deposit/withdrawal limits.

KYC Limits:

On Bybit, you will find two levels of KYC. These are:

- Level 1: A monthly withdrawal limit of 1,000,000 USDT and daily fiat top-up limit of 20K USDT with unlimited P2P trading.

- Level 2: A monthly withdrawal limit of 2,000,000 USDT and daily fiat top-up limit of 100K USDT with unlimited P2P trading.

Verdict: Since both exchanges require you to complete your identity verification or KYC, it is a tie between Independent Reserve and Bybit.

Independent Reserve vs Bybit: Deposits & Withdrawal Options

Independent Reserve

- Method 1: You can deposit or withdraw fiat currencies like AUD, and NZD using Australian banks. Alternatively, you can also deposit fiat using USD Swift or Assisted transfer.

- Method 2: Deposit/withdraw crypto tokens using another crypto wallet or exchange.

Bybit

- Method 1: You can deposit/withdraw fiat using payment options like bank transfer, Zeller, Wise, bank card, etc.

- Method 2: You can deposit/withdraw funds using Bybit’s P2P trading.

- Method 3: Deposit/withdraw crypto tokens using another crypto wallet or exchange.

Verdict: As Bybit offers multiple ways to deposit and withdraw funds, it is the winner for this section.

Independent Reserve vs Bybit: Trading & Platform Experience Comparison

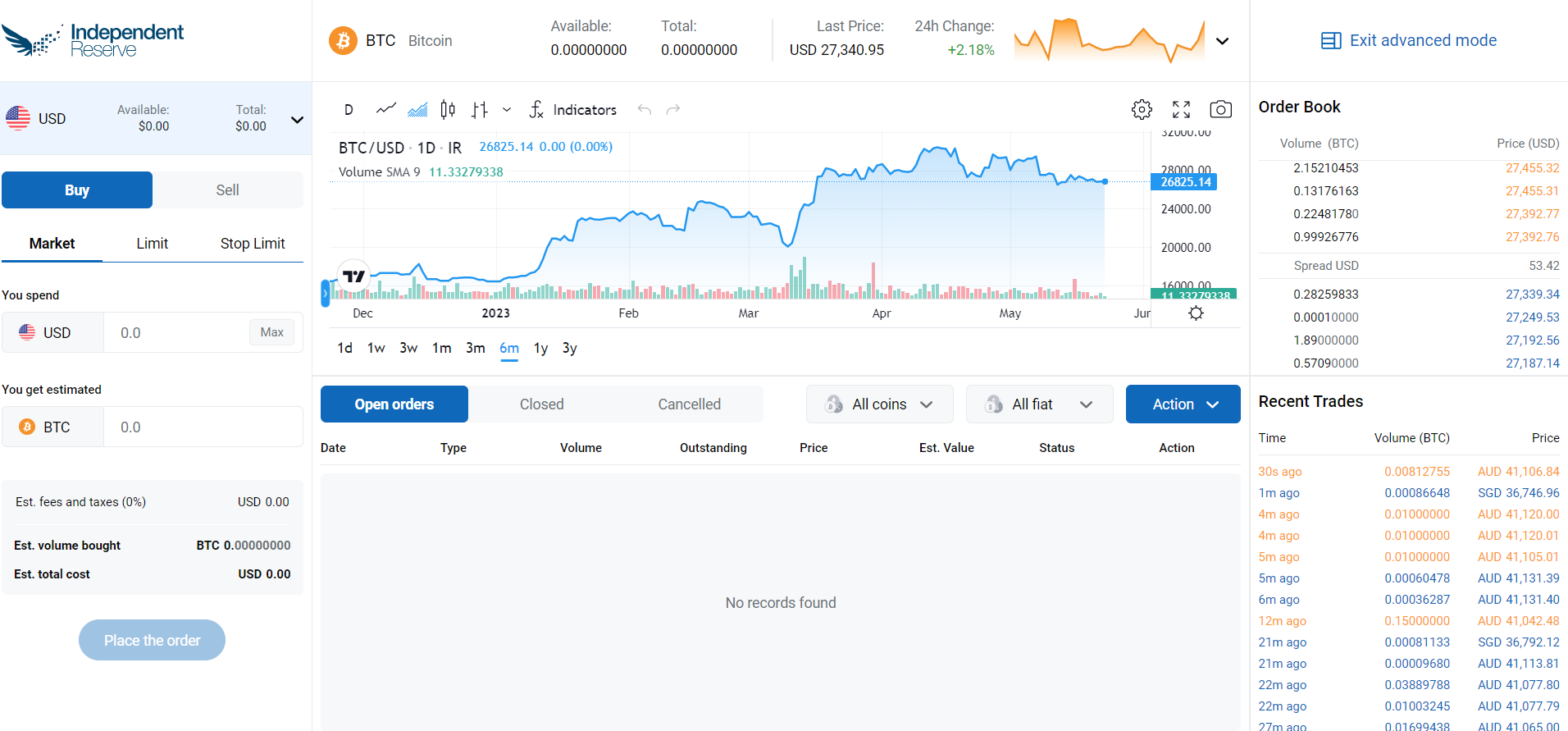

Independent Reserve

Independent Reserve is more of a crypto investment platform than a trading platform.

As a result, it doesn’t offer you too many features in terms of trading. But as long as your primary job is crypto investing, and it has some really cool features.

Such as:

- Technical Chart powered by Trading View

- Easy-to-use order form

- Trading pair details

- Order book

- Estimated fees and taxes info

- Open orders, closed orders and cancelled orders

- Auto trader – create your own trading strategy

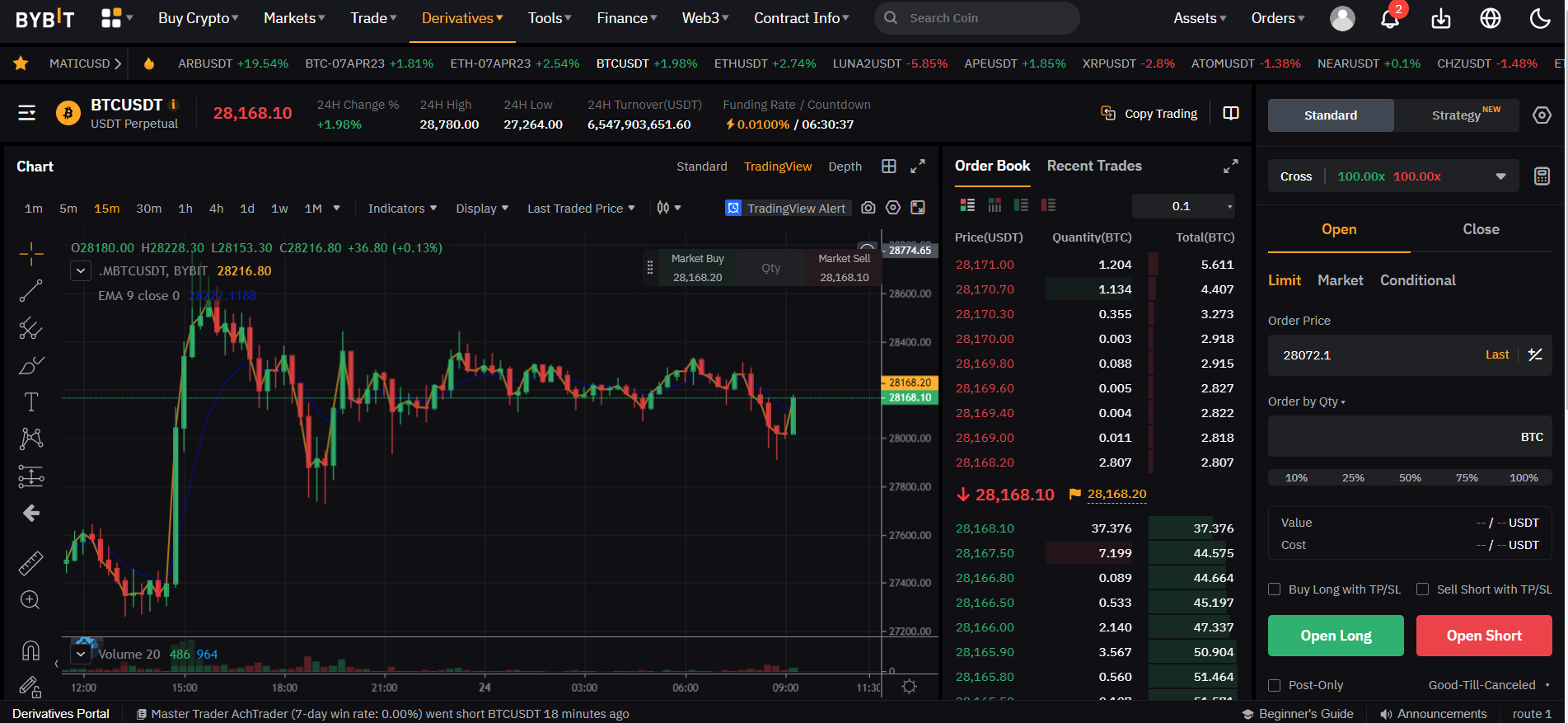

Bybit

On the other hand, Bybit is a preferred option for both crypto investing and trading. And it offers you all the important features that you need for opening trades. Such as:

- Multiple technical charts, including TradingView

- Easy-to-use order form

- Trading pair details

- Order book

- Recent trades

- Positions closed P&L, Current orders, order history, and trade history

- Easy-to-use mobile app

To learn more about the exchange, you can check this quick guide on how to use Bybit exchange.

Verdict: Overall, Bybit’s trading platform is much better and offers you tons of trading features that let you trade effectively. Also, it has an advanced trading platform across the web and mobile app.

Independent Reserve vs Bybit: Customer Support

Independent Reserve

Independent Reserve doesn’t offer you many ways to reach out to customer support. The only way you can get help is by raising a support ticket.

However, they do have a quick response time. Along with that, you are also getting access to different help guides, which will allow you to solve your queries on your own.

Bybit

Bybit is a better choice in terms of customer support. You can contact them via their live chat option, which will instantly connect you with a support agent. Along with that, you can also access their help guides.

If you want to get help, you can reach out to them via their support email. Or you can contact Bybit on Twitter to solve your queries.

Verdict: Bybit is the clear winner for this segment, as the exchange offers you multiple ways to contact the support team.

Independent Reserve vs Bybit: Security Features

Independent Reserve

- Two-factor authentication

- Browser whitelisting

Bybit

- Two-factor authentication

- Fund Password

- Anti-phishing Code

- Real-Time Monitoring

- Withdrawal Address Whitelist

- Withdraw via Address Book

- Trusted Devices Management

- Triple Layer Asset Protection & Platform Security

- Advanced-Data Protection

Verdict: As you can see, Bybit offers you tons of security features, whereas Independent Reserve’s security features are pretty limited. Hence, Bybit emerges as the clear winner for this segment.

Is Independent Reserve Safe & Legal To Use?

Independent Reserve is a reputable and legitimate cryptocurrency exchange.

The exchange has implemented several security measures and uses cold storage to protect user funds and personal information.

Along with that, the exchange also maintains segregation of customer holdings. Plus, the exchange has its books balanced, and there is no debt on our balance sheet.

Is Bybit Safe & Legal To Use?

Bybit is one of the most well-known global crypto exchanges out there.

With zero histories of hacks and security breaches, Bybit is known for offering a safe haven for crypto traders.

The exchange also uses cold storage and has implemented several features to protect customer details and their funds.

Also, Bybit users are getting several features to protect their accounts from any potential hacks.

Independent Reserve vs Bybit: Why not use both?

Overall, it is Bybit that wins this comparison.

It is the best future exchange that not only offers you an easy crypto investment solution.

But it also allows you to trade cryptocurrencies effectively thanks to the low trading fees, availability of crypto tokens, and high leverage.

But Independent Reserve cannot be ignored as well. It is a suitable option for both individuals and businesses to invest in crypto with proper regulations.

Learn how does Independent Reserve & Bybit stack up against the competition:

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023

- Best Cardano (ADA) Wallets To Use In 2024 - May 7, 2023