Binance and Delta Exchange are two of the leading cryptocurrency derivatives trading exchanges out there. Both of them allow you to trade in similar market types and have other features.

Hence for any newbie, it can get really confusing to choose between Binance and Delta Exchange.

In case you too are confused between these two exchanges, then to help you out, I have compared both of them below at various factors.

So let’s quickly go ahead and have a look at them:

Binance vs Delta Exchange: At A Glance Comparison

Binance Futures is known as the largest crypto trading exchange by trading volume. The exchange is a suitable option for both beginners and advanced traders.

Also, the exchange allows you to trade in various markets such as spot, options, margin and futures with lucrative leverage and trading fees.

The exchange is also widely trusted and used and offers a bunch of crypto financial services, such as crypto loans, staking, DeFi, liquidity farming, and more.

Delta Exchange is also one of the leading crypto options trading platforms. The exchange has its main focus on futures and options trading. But it also allows you to trade in the spot market.

The exchange was launched back in 2018, and over the years, it has become the trusted platform to trade crypto options.

Apart from derivatives trading, you can also use the exchange for a few other crypto use cases, such as staking and automated investments.

Binance vs Delta Exchange: Trading Markets, Products & Leverage Offered

Both Binance and Delta Exchange have a few similar markets but are extremely different from each other.

Binance

- Spot Trading

- Margin trading with leverage ranging from 3x to 5x

- Futures Market

- USD-M and BUSD perpetual contracts with up to 125x leverage

- Coin-M perpetual contracts with up to 125x leverage

- Crypto Options (European style)

- Binance Leveraged Tokens trading with up to 4x leverage

- P2P trading

Delta Exchange

- Crypto Options trading

- Crypto perpetual trading with up to 100x leverage

- Spot Trading

Verdict: In terms of product offerings, Binance is superior and the winner for this section. It offers you more market types than Delta Exchange.

Binance vs Delta Exchange: Supported Cryptocurrencies

Binance

Binance is the largest crypto exchange. As a result, it works as the launch platform for many new cryptos. If we talk about the supported tokens available on Binance, you will get access to 500+ crypto tokens and trading pairs. Some of the listed tokens are:

- BTC

- ETH

- RPL

- BNB

- HFT

- AGLD

Delta Exchange

Delta Exchange isn’t really impressive when it comes to supported trading pairs. For spot trading, you are only getting six trading pairs.

However, futures trading has an extended number of trading pairs. But it is still limited.

Some of the available tokens are:

- DETO

- ETH

- BTC

- SOL

- USDC

- XRP

Verdict: As Binance has more supported tokens compared to Delta Exchange, it is the clear winner.

Binance vs Delta Exchange: Trading Fee & Deposit/Withdrawal Fee Compared

Binance Spot Trading Fee

The Binance trading fee is pretty straightforward. It follows the standard tiered fee structure with a maker-and-taker fee model.

Also, it offers you a 25% discount on spot trades when you use BNB to pay for the trading fees. And here is how the regular and discounted spot trading fee stands at:

| Regular Fee | 25% Discounted Fee | |

| Maker Fee | 0.1000% | 0.0750% |

| Taker Fee | 0.1000% | 0.0750% |

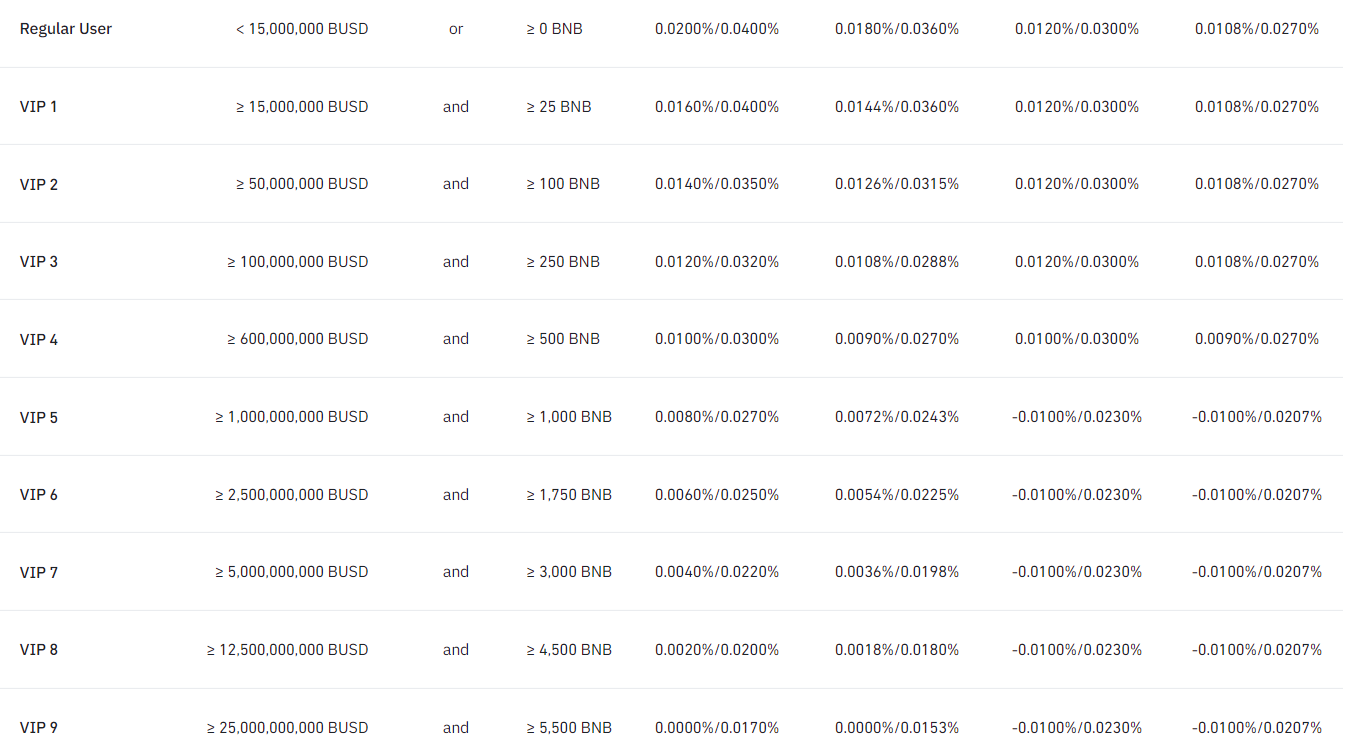

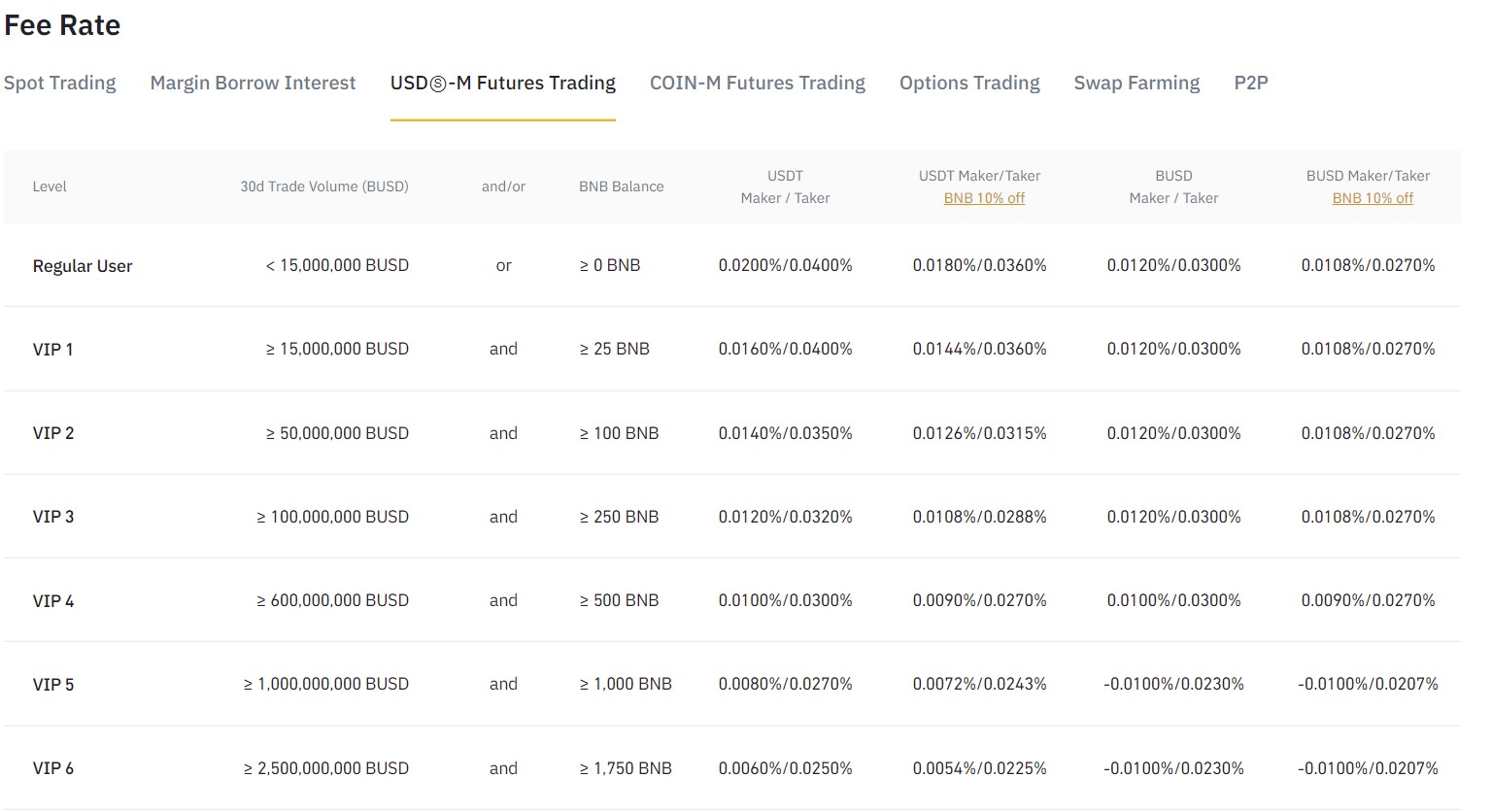

Binance Futures Trading Fee

A similar tiered fee structure and a discounted trading fee can also be seen for Binance futures trading fees. However, you are only getting a 10% discount on futures trades for USDT and BUSD contracts.

And here is how the fee structure stands out:

| USD-M Futures Fee | Regular Fee | 10% Discounted Fee |

| Maker Fee | 0.0180% | 0.0108% |

| Taker Fee | 0.0360% | 0.0270% |

| BUSD Futures Fee | Regular Fee | 10% Discounted Fee |

| Maker Fee | 0.0120% | 0.0108% |

| Taker Fee | 0.0300% | 0.0270% |

| Coin-M Futures Fee | Regular Fee | |

| Maker Fee | 0.0100% | |

| Taker Fee | 0.0500% | |

| Binance Options Trading Fee | Regular Fee | |

| Maker Fee | 0.020% | |

| Taker Fee | 0.020% |

Binance Deposit & Withdrawal Fees

Coming to deposit fees, Binance doesn’t charge you anything when you deposit crypto on the exchange. But if you are depositing fiat using a credit/debit card, bank transfer, or other similar payment methods. Then it will be subjected to a transaction fee.

But for withdrawals, Binance does charge you certain fees. The fee depends on what currency you are withdrawing.

However, you can avoid depositing and withdrawing fees completely by using Binance’s P2P trading.

Delta Exchange Spot Trading Fee

Delta Exchange also has a straightforward trading fee. It doesn’t follow any tiered fee structure or offers you any discount. Instead, it charges you a flat fee for spot trading at:

- Maker Fees: 0.05%

- Taker Fee: 0.05%

Delta Exchange Futures Trading Fee

For futures trading, you also don’t get any discount or tier. Instead, it charges you a flat rate for inverse futures, USDT linear futures, and ALT-BTC futures.

Inverse Futures

- Maker Fees: 0.02%

- Taker Fees: 0.05%

USDT Linear Futures

- Maker Fees: 0.02%

- Taker Fees: 0.05%

ALT-BTC Futures

- Maker Fees: 0.1%

- Taker Fees: 0.1%

Options Trading

For options trading, it has one of the lowest trading fees in the market. And here is how it stands:

- Maker Fees: 0.3%

- Trading Fees: 0.3%

- Settlement Fees: 0.3%

Delta Exchange Deposit & Withdrawal Fees

For crypto tokens deposit, there are absolutely no fees. But for crypto withdrawals, you have to pay withdrawal fees which vary from one crypto token to another one.

Also, there is no P2P trading available. So you cannot really enjoy free deposits and withdrawals.

Verdict: Although both exchanges have low trading fees. But still, Binance is the winner. It offers you heavy discounts with different tiers. Plus, its options trading fee is lower than Delta Exchange.

Binance vs Delta Exchange: Order Types

On both exchanges, you will find a few similar yet different order types. These are:

Binance

- Limit

- Market

- Stop Limit

- Stop Market

- Trailing Stop

- Post Only

- TWAP

Delta Exchange

- Limit

- Market

- Conditional

- Stop Limit

- Stop Market

- Trailing Stop

- Taker Profit Market

- Take Profit Limit

Verdict: As there is not much of a difference in terms of supported tokens, it is a tie between Binance and Delta Exchange.

Binance vs Delta Exchange: KYC Requirements & KYC Limits

Binance

Binance made it mandatory to complete your KYC verification. You need to verify your account to be allowed to deposit or withdraw funds or participate in trading activities.

However, it does have different KYC levels, which enhances your trading privileges.

KYC Limits

Binance has three levels of KYC. These levels are:

- Verified: It will unlock a daily fiat limit of 50,000 USDT daily.

- Verified Plus: It will unlock a daily fiat limit of 2M USDT daily.

- Verified Plus (2): It will unlock unlimited fiat transactions.

Delta Exchange

For Delta Exchange also, KYC is mandatory. You need to verify your account to be allowed to deposit fiat or crypto. As a result, you cannot place traders or withdraw from the exchange.

Also, unlike Binance, it doesn’t have different KYC levels that will enhance your trading privileges on the exchange.

Binance vs Delta Exchange: Deposits & Withdrawal Options

Binance

- Method 1: You can use your credit/debit card, bank transfer, or other third-party available payment methods to buy crypto.

- Method 2: Use Binance’s P2P trading to deposit and withdraw fiat in your local payment methods at zero cost.

- Method 3: You can transfer crypto from another exchange or wallet to Binance’s wallet.

Delta Exchange

- Method 1: Buy crypto using credit/debit cards or other available payment methods.

- Method 2: Deposit or withdraw crypto using another crypto wallet or exchange.

Verdict: As Binance supports more ways to deposit and withdraw funds, it is the winner for this section.

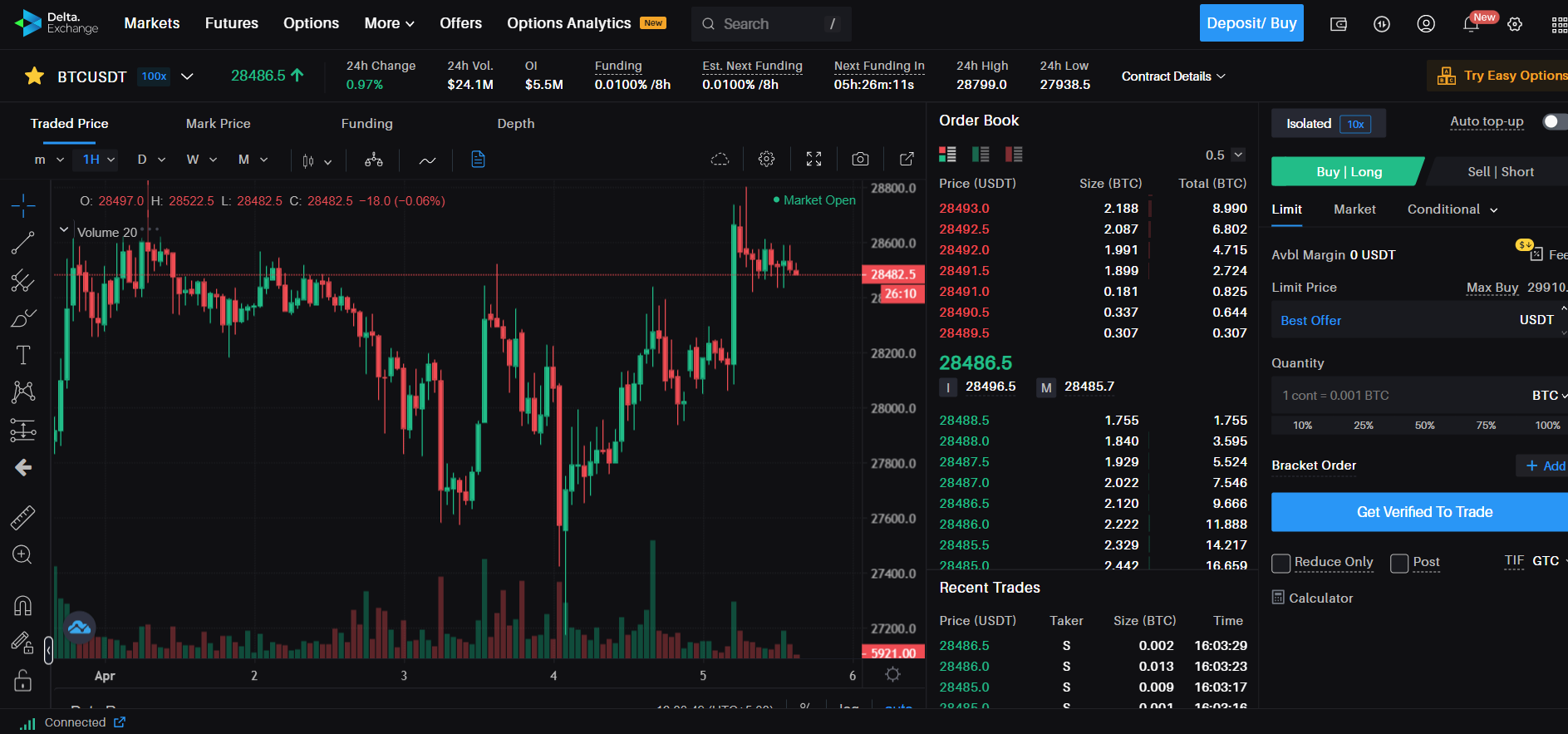

Binance vs Delta Exchange: Trading & Platform Experience Comparison

Binance

- Multiple technical chart options, including TradingView

- Pair details

- Order book

- Easy-to-use order form

- Trade history, open orders, PnL records

- User-friendly mobile app

Delta Exchange

- Technical chart powered by TradingView

- Trading Pair Details

- Easy-to-use order form

- Auto top-up

- Order book

- Recent trades

- Positions, open orders, conditional orders, trading balances & fills

- Order history

Verdict: Overall, there is not much difference between both exchanges’ trading interfaces. Hence, it is a tie between these two exchanges.

Binance vs Delta Exchange: Customer Support

Binance

Getting help from Binance support is super easy and quick. You can find a live chat window on Binance’s homepage which can be used to access different help guides or connect with a live support agent.

Also, you can reach out to them via email or get help from social media channels like Twitter at @BinanceHelpDesk.

Delta Exchange

Delta Exchange support isn’t as good as Binance as there is no live chat option. But it makes it super easy for you to raise a support ticket and get help. Alternatively, you can also get help from its social media channels like Twitter at @DeltaEx_Support.

Verdict: Overall, the Binance support team is easier to connect with. Hence, it is the winner for this section.

Binance vs Delta Exchange: Security Features

Binance

- Passkeys and Biometrics

- Keeps funds in cold storage

- Two-factor Authentication

- Real-Time Monitoring

- Advanced-Data Encryption

- Withdrawal Whitelist

- Anti-Phishing Code

- Device Management

Delta Exchange

- Google Authenticator

- Account Activity logs

- Safe Session Duration

- Address Management

Verdict: As you can see, Binance offers you more security features compared to Delta Exchange. So it is the winner for this section.

Is Binance Safe & Legal To Use?

Binance is one of the safest crypto exchanges to use. It offers you several features to safeguard your account. Plus, the exchange keeps a majority of users’ funds in cold storage.

Also, the exchange has implemented several security features to protect the overall security of the exchange. Plus, the exchange hasn’t been hacked to date.

So yes, you are going to get a safe trading experience while using Binance.

Is Delta Exchange Safe & Legal To Use?

Delta Exchange is one of the leading platforms for trading crypto. It offers a bunch of security features to help you safeguard your account.

Plus, the exchange has made it mandatory to complete KYC for ultimate protection. Along with that, the exchange keeps a majority of the user’s funds in cold storage. Also, the exchange hasn’t undergone any hacking attacks to date.

Binance vs Delta Exchange Conclusion: Why not use both?

Both Binance and Delta Exchanges are pretty solid in their respective fields. However, Binance is a far better choice than Delta Exchange.

The exchange allows you to trade in different markets compared to Delta Exchange which mainly focuses on derivatives trading. Also, it has lower trading fees and supports P2P trading.

But Delta Exchange cannot be ignored at all. This platform is an excellent option for anyone looking to trade crypto options in the easiest way possible.

Check out how Binance & Delta Exchange competing with other crypto exchanges:

- Binance vs Bybit

- Binance vs Huobi

- Binance vs Phemex

- Binance vs Okx

- Binance vs Luno

- Delta Exchange vs ByBit