Deribit or Binance are two powerhouse platforms with strengths, specialties, and quirks.

But hold on, this isn’t a choice you must make blindly.

This article will break down Deribit and Binance, comparing them across essential parameters like fees, user experience, support assets, etc.

Seasoned traders or complete newcomers, we’ve got insights tailored just for you.

Ready to make an informed choice?

The battle of Deribit vs Binance begins now!

Deribit vs Binance: At A Glance Comparison

Before we go in-depth, here’s a quick side-by-side comparison of Deribit and Binance – the two giants in the crypto world.

This will give you a bird’s-eye view of what each platform offers.

| Factors | Deribit | Binance |

| Founded in | 2016 | 2017 |

| Supported Cryptocurrencies | BTC, ETH | 200+ |

| Leverage | Up to 100x | Up to 125x |

| KYC Requirement | Optional | Yes, for high-volume trading |

| Fees | Relatively low | Very competitive |

| Products | Futures, options | Spot trading, futures, margin trading, staking, DeFi, NFTs |

| Security | High (Cold storage) | High (SAFU Fund, Cold storage) |

With more supported cryptocurrencies and a more comprehensive range of trading products, Binance Futures takes the lead here.

But hang on! This is just the tip of the iceberg.

We’re about to dig deeper, so keep reading to make an informed decision.

Deribit vs Binance: Trading Markets, Products & Leverage Offered

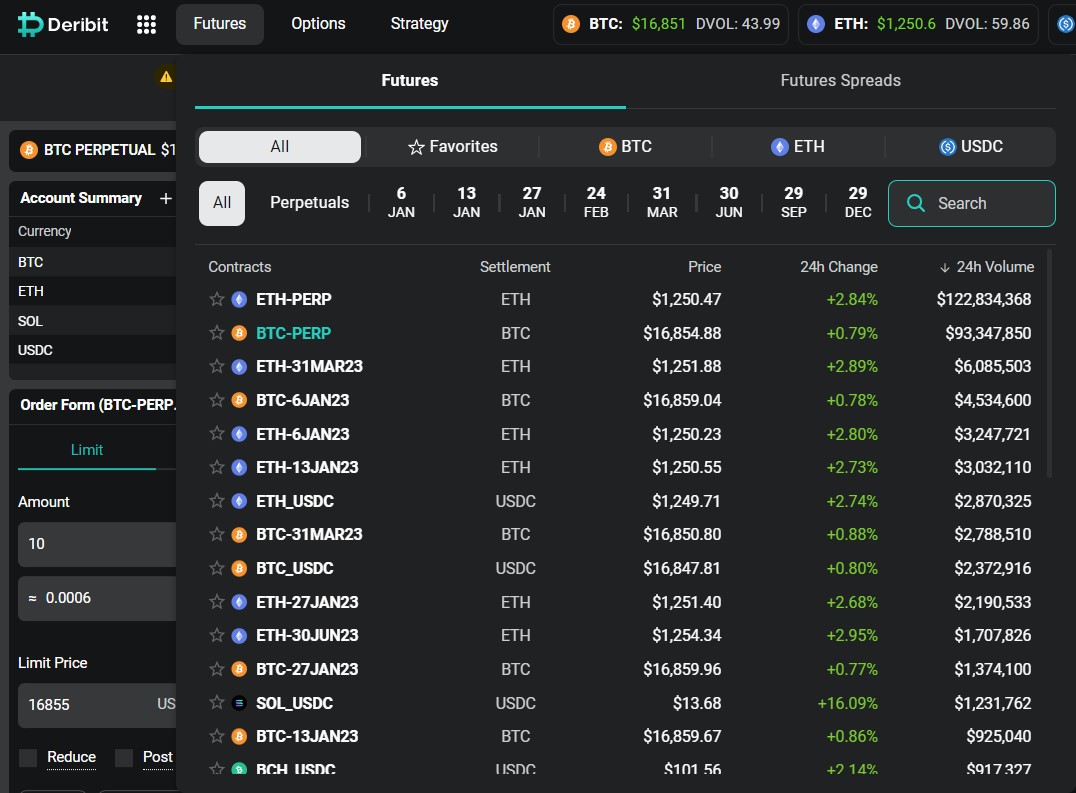

Starting with Deribit, it’s a niche platform that exclusively focuses on Bitcoin and Ethereum derivatives trading.

On the other hand, Binance is more like a one-stop shop for all things crypto. It offers an extensive range of products, from spot trading, Futures, margin trading to staking, DeFi, and even NFTs.

Regarding leverage, Binance turns the heat up a notch, providing up to 125x on specific trades.

In a nutshell, Deribit shines for its focused derivative offerings, while Binance excels with its extensive range and higher leverage.

So, which one is better?

If you’re a derivatives trader looking for laser-focused tools and products, Deribit is your go-to. But if you’re seeking a broader trading playground with diverse opportunities and high leverage, Binance steals the show.

Deribit vs Binance: Supported Cryptocurrencies

Deribit is very targeted in its approach, offering Bitcoin and Ethereum derivatives.

This narrow focus allows them to deliver excellent, tailored services for traders interested in these two significant cryptocurrencies.

Conversely, Binance is the place to be for variety seekers.

As of writing, it supports trading in over 500 cryptocurrencies.

It’s not just about the major players here – Binance embraces diversity, covering a wide range of altcoins and even newly launched tokens.

So, who comes out on top?

If you’re all about Bitcoin and Ethereum and want a platform specializing in these coins, Deribit might be the one for you. But if you’re a cryptocurrency explorer looking for a wide range of options, Binance unquestionably holds the crown in this aspect.

Deribit vs Binance: Trading Fee & Deposit/Withdrawal Fee Compared

On Deribit, the trading fees range from 0.05% for Futures to 0.02% for Options, which is relatively competitive.

Withdrawal fees on Deribit are standard, with Bitcoin withdrawals incurring a 0.0006 BTC charge and Ethereum withdrawals set at 0.01 ETH.

Not bad at all, right?

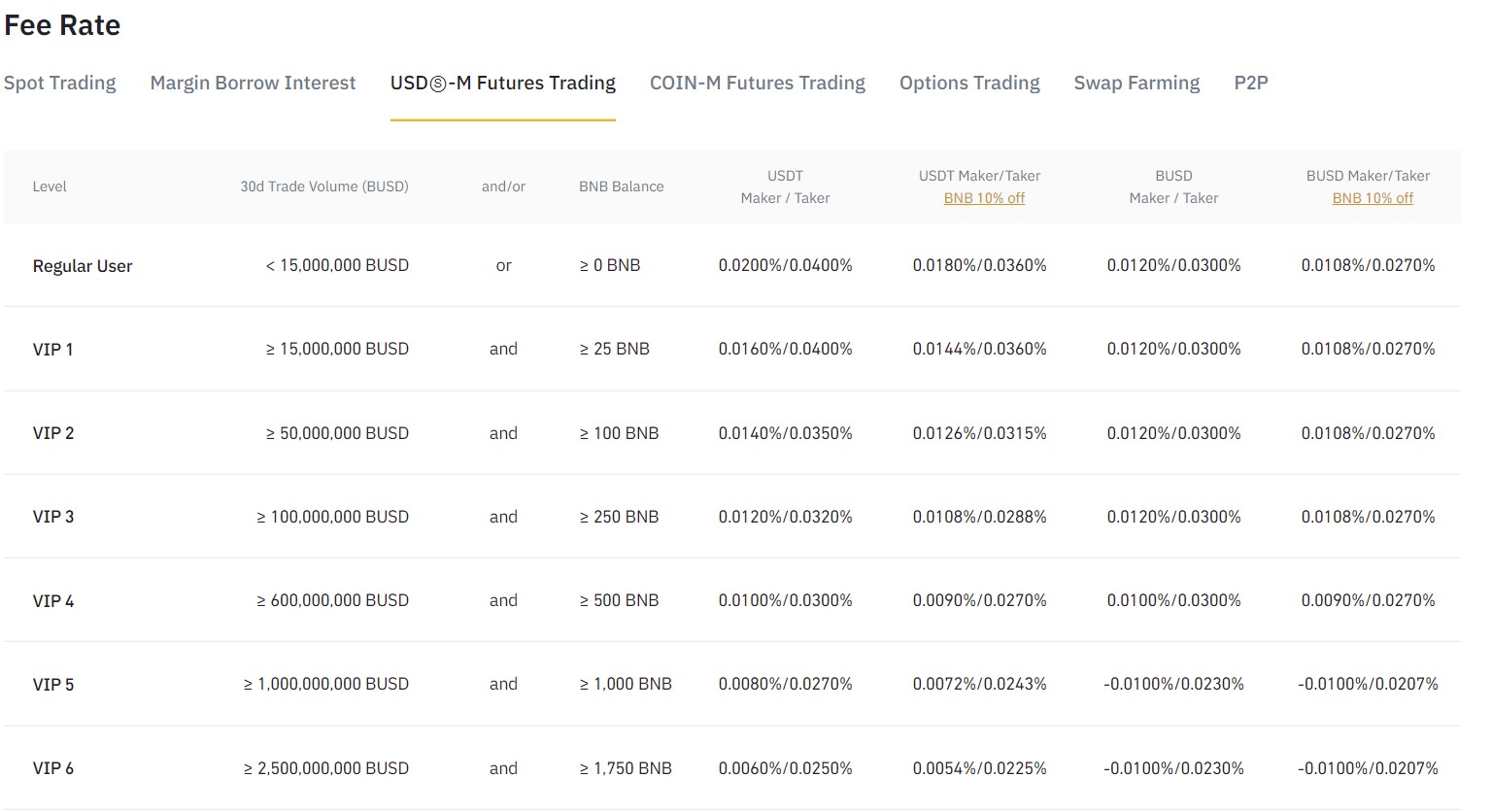

Now, let’s switch gears to Binance.

Binance operates on a tiered tradingfee structure, which starts from 0.1% and can go as low as 0.02% based on the user’s 30-day trading volume and $BNB balance.

This means the more you trade, the less you pay. On top of this, Binance also offers discounts if you opt to use their BNB token to pay transaction fees.

Withdrawal fees depend on the specific coin but are generally competitive.

For casual traders and those not keen on holding $BNB, Deribit’s straightforward, low-fee model is hard to beat.

But for heavy traders and those willing to optimize their $BNB use, Binance’s tiered and discounted fee system could offer significant savings.

So, choose the one that aligns best with your trading strategy and volume.

Deribit vs Binance: Order Types

Deribit supports several order types, including market orders, limit orders, stop limit orders, and stop market orders.

This lineup provides traders a good array of options to manage their trades effectively. It might not be exhaustive, but it covers the bases.

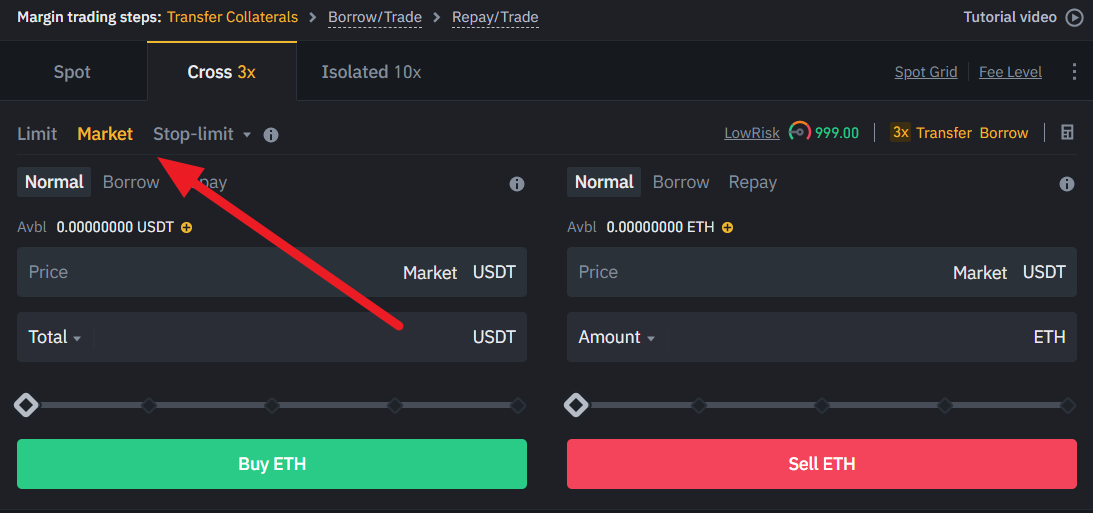

On the other hand, Binance offers an even more comprehensive range of order types.

In addition to Deribit’s offerings, Binance supports advanced order types like trailing stop orders, OCO (One Cancels the Other), and iceberg orders.

It’s clear to see.

If you’re a sophisticated trader looking for more advanced trading strategies, Binance covers you.

Taking this into account, Binance takes the lead in this category. Its wider variety of order types gives traders more flexibility in executing their trading strategies.

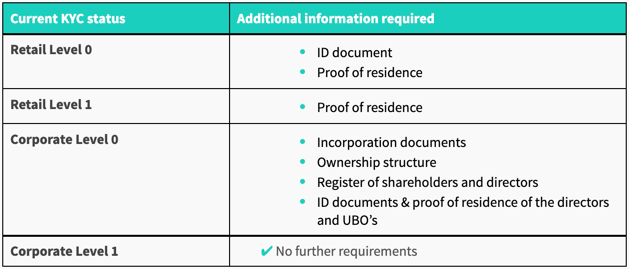

Deribit vs Binance: KYC Requirements & KYC Limits

Beginning with Deribit they have a two-tiered KYC process.

The first level doesn’t require any KYC verification and allows up to 1 BTC daily withdrawal. Level 2 requires a complete KYC process but raises the withdrawal limit to unlimited.

This flexibility is a breath of fresh air for those who prefer to trade anonymously to some extent.

Now, let’s turn the spotlight to Binance.

Binance requires you to complete KYC before making any trades on the exchange.

So, who takes the trophy in this arena? Deribit’s Level 1 KYC requirements are more relaxed if anonymity is your priority. But if you’re all about the high limits, Binance’s generous allowances after KYC are hard to beat.

Deribit vs Binance: Deposits & Withdrawal Options

Kicking off with Deribit, it’s crucial to note that this platform is a crypto-only exchange, meaning you can only deposit and withdraw in cryptocurrencies, specifically Bitcoin and Ethereum.

There are no options for fiat transactions, which may limit some users, especially newcomers to the crypto scene.

On the flip side, Binance showcases its versatility once again.

Binance allows both crypto and fiat transactions.

They provide many options, including bank transfers, credit/debit card payments, and third-party platforms like Simplex and Paxos.

After digesting all this information, the verdict seems clear.

While Deribit’s crypto-only approach might appeal to hardcore crypto enthusiasts, Binance’s variety of deposit and withdrawal options opens the doors for a broader range of experienced and new users.

Therefore, regarding versatility and accessibility, Binance takes the cake in this comparison.

Deribit vs Binance: Trading & Platform Experience Comparison

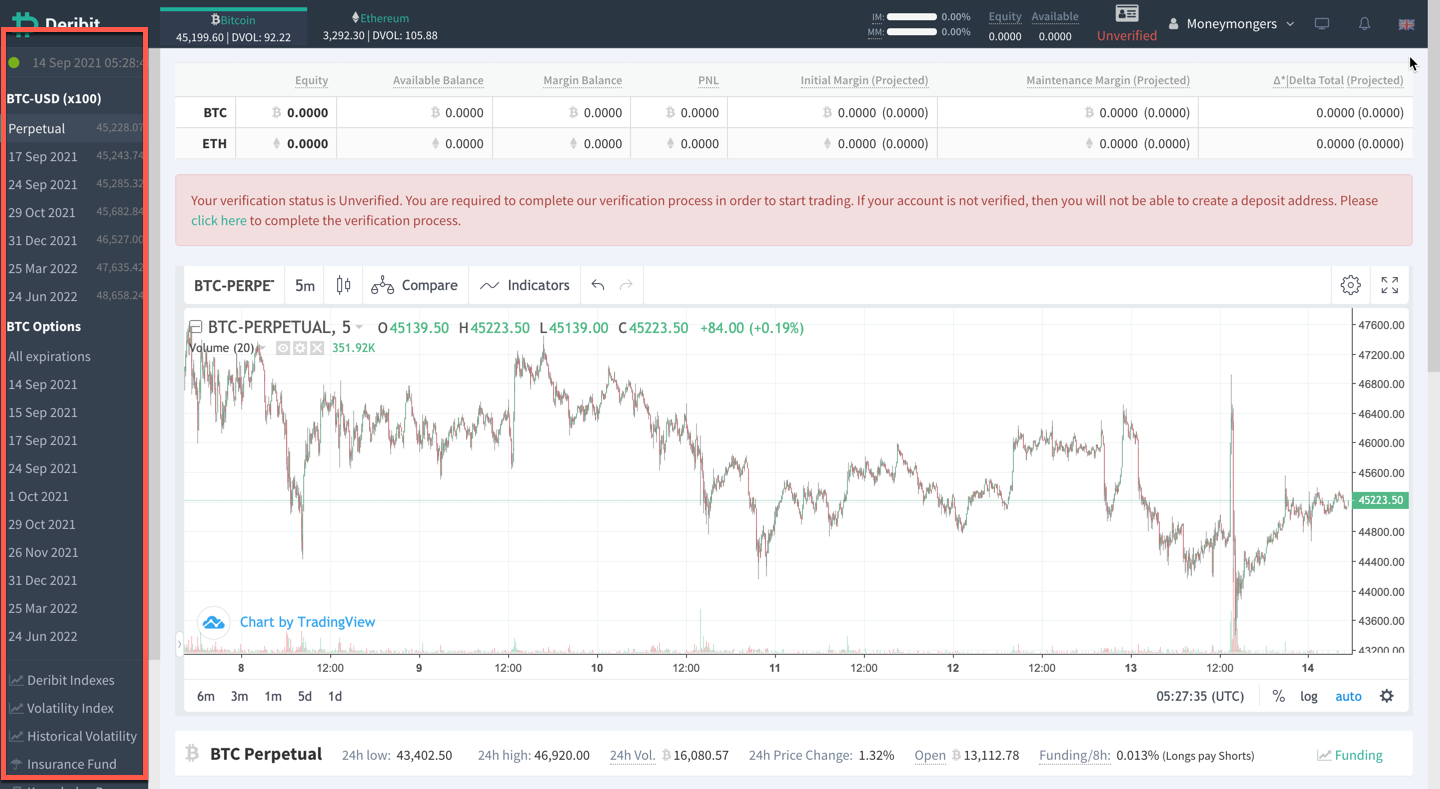

Starting with Deribit, it presents a straightforward, intuitive user interface with a critical focus on Futures and Options trading.

It provides an extensive set of trading tools and charts, making it an excellent pick for those specifically into derivative trading.

The platform is smooth, with high-speed trade executions, and it can handle substantial trade volumes without a hitch. To learn more, you can check this guide on how to trade crypto futures on Deribit.

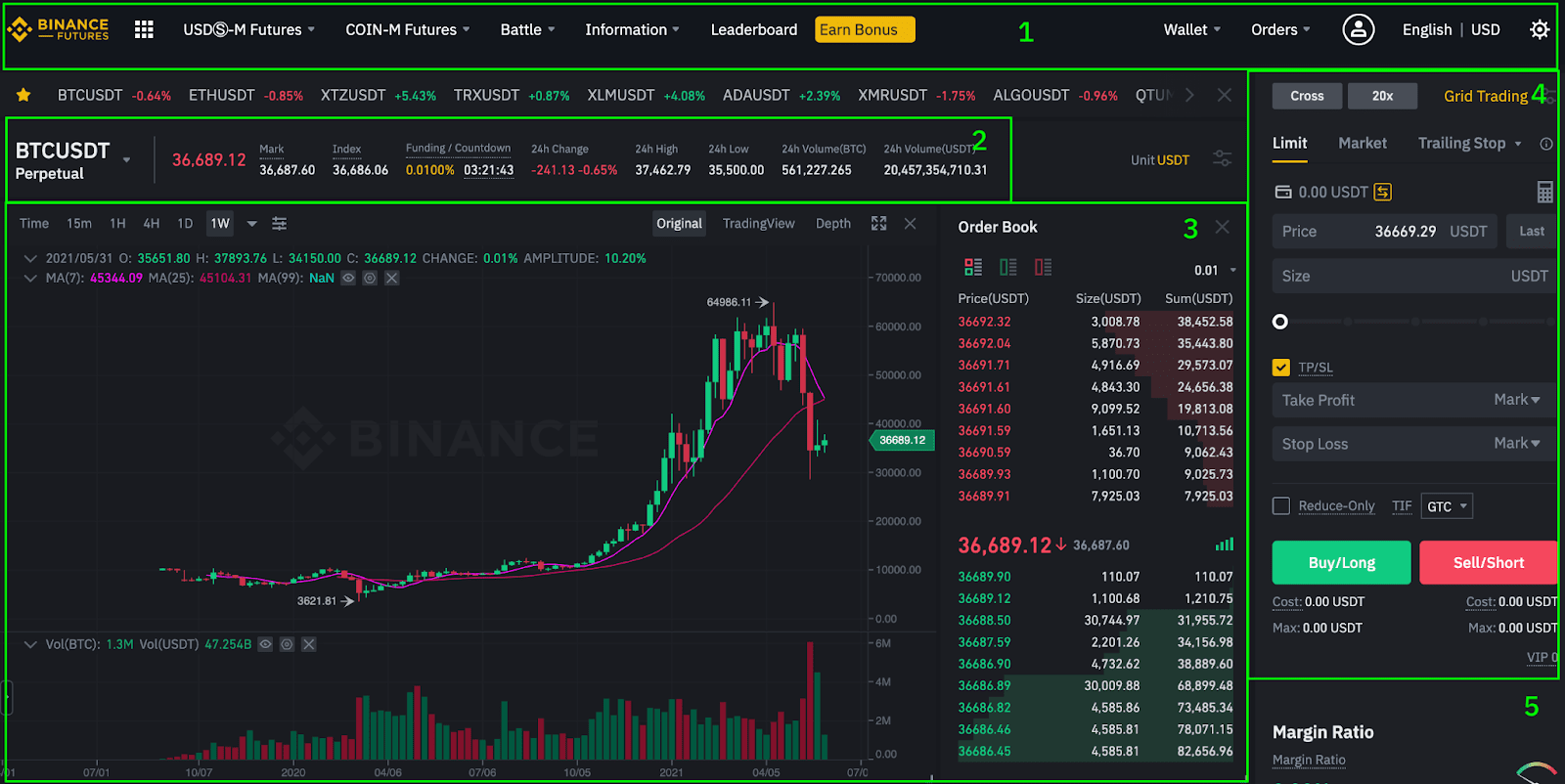

However, the competition gets trickier when you turn your attention to Binance.

Binance boasts a comprehensive trading platform catering to novice traders and experts alike.

It offers two primary interfaces – Basic and Advanced, allowing users to switch based on their comfort level.

Advanced charts, a wide variety of order types, spot trading, Futures trading, margin trading – you name it, Binance has it.

Plus, Binance’s platform is available in several languages, making it more user-friendly for a global audience.

So, here’s the deal – if you’re primarily into derivative trading, you might find Deribit’s focused approach more appealing. However, suppose you’re looking for versatility, a range of trading options, and a user-friendly platform; Binance is the clear winner.

Deribit vs Binance: Customer Support

Deribit offers various support options, including a comprehensive FAQ section and email support.

They also maintain an active presence on social media platforms like Twitter, frequently addressing user queries.

While these channels provide adequate support, the absence of live chat or phone support may limit real-time assistance.

On the other hand, Binance goes above and beyond with its customer support. Alongside an extensive FAQ section and email support, it offers 24/7 live chat support in multiple languages.

This is a huge advantage for users who may require immediate assistance.

Besides, they also have a comprehensive collection of tutorials and guides, perfect for troubleshooting or learning new features.

In sum, while Deribit and Binance offer customer support, Binance takes the upper hand here with its round-the-clock live chat support.

After all, in the dynamic world of crypto trading, having access to immediate help can be a game-changer, don’t you agree?

Deribit vs Binance: Security Features

On one side, Deribit is implementing standard security measures such as two-factor authentication and cold storage for most of its user’s funds.

They have also introduced an insurance fund to cover potential losses from Futures trading, showing their commitment to user security.

Conversely, Binance sets the bar high with comprehensive security measures. Along with two-factor authentication, they employ AI risk control solutions and withdrawal whitelist functionality.

In case of any security breach, they have a ‘SAFU’ (Secure Asset Fund for Users) fund to compensate users, which adds another layer of protection.

Here, Binance steals the show with its advanced features and the added assurance of the SAFU fund.

Is Deribit Safe & Legal To Use?

The good news is that Deribit has a solid track record in the industry.

Regarding legality, the platform operates under the jurisdiction of Panama and complies with its local laws and regulations.

It’s a fully registered and legal entity, giving traders an additional layer of trust.

As far as safety is concerned, Deribit has implemented numerous security measures.

For instance, it uses cold storage to keep most users’ funds offline and safe from potential online threats. Plus, they have two-factor authentication for enhanced account security.

Importantly, Deribit has never experienced a significant security breach — a rare accomplishment in the crypto world.

So, if you’ve been wondering, ‘Is Deribit safe and legal to use?’ The answer is a resounding ‘Yes.’

Is Binance Safe & Legal To Use?

Let me clear the air: Binance is one of the world’s largest and most well-known cryptocurrency day trading exchange.

It’s a fully registered and legal entity headquartered in Malta and complies with its local regulations.

Now, let’s talk about safety.

Binance incorporates a range of security measures like a two-factor authentication withdrawal whitelist and uses an advanced system architecture built to protect against potential threats.

The platform also has a ‘Secure Asset Fund for Users’ (SAFU) that provides an additional safety net for users’ funds.

While Binance has had a history of minor security incidents, the platform has responded swiftly to these and has demonstrated a solid commitment to maintaining the security of its users’ assets.

So, to answer your question: ‘Is Binance safe and legal?’ It certainly is.

Deribit vs Binance Conclusion

Here’s the bottom line: If you focus on crypto derivatives trading, particularly Bitcoin and Ethereum options, Deribit might be your best bet.

It provides industry-leading services in that respect.

If you’re a diversified trader looking for access to a broad range of cryptocurrencies and comprehensive spot market trading, Binance has the edge.

Remember, the choice between Deribit and Binance depends on your needs and trading preferences.

There’s no one-size-fits-all exchange.

So why not take a closer look at both, and decide which meets your specific requirements?

Learn how does Deribit & Binance stack up against the competition:

- Deribit vs. BitMEX

- Deribit vs. Bybit

- Binance vs. Phemex

- Binance vs. StormGain

- Binance vs. Bitfinex

- Binance vs. BingX