When looking for the perfect crypto exchange, the choices are overwhelming, but two platforms have consistently caught my attention: Gemini and Binance.

Both Gemini and Binance are two well-known and respected in the crypto world, but which one is better?

In this article, I’ll dive deep into the features, fees, security, and user experience of both exchanges to help you make an informed decision.

Whether you’re a seasoned trader or just getting started, this comparison will provide valuable insights to help you choose the right platform for your crypto journey.

Gemini vs Binance: At A Glance Comparison

Feature

Gemini

Binance

User Interface

Easy to use

Feature-rich

Fees

Higher compared to other exchanges

Lower fees overall

Security

Top-notch security with a strong focus on regulatory compliance

Robust security measures in place, including two-factor authentication and withdrawal whitelist

Supported Cryptocurrencies

Limited selection of cryptocurrencies

Extensive range of cryptocurrencies

Trading Options

Basic trading options for beginners and casual traders

Advanced trading options, including Futures, margin trading, and staking

Regulation

Highly regulated in the US

Less regulated, operating in multiple jurisdictions

Mobile App

User-friendly mobile app available for iOS and Android

Comprehensive mobile app on iOS and Android

Customer Support

Responsive and helpful customer support

Varied customer support options, including live chat

Gemini vs Binance: Trading Markets, Products & Leverage Offered

When it comes to these things, both Gemini and Binance Futures have a lot to offer.

But which one is better suited for your needs?

Let’s dive in and find out.

Gemini:

1. Trading Markets: When trading on Gemini, you can trade major tokens and other smaller coins in spot trading and futures. You can also dabble in NFT trading using their Nifty Gateway marketplace.

2. Products: Gemini offers spot trading, a derivatives trading platform called ActiveTrader, a credit card to earn crypto rewards, and a program to earn interest on your crypto called Staking.

3. Leverage: Gemini offers up to 100x leverage on the derivatives contracts it has available.

Binance:

1. Trading Markets: Binance boasts an extensive range of cryptocurrencies compared to Gemini.

2. Products: Binance products include spot trading, Perpetual Futures trading, margin trading, liquidity pools, staking, and a wide range of services.

3. Leverage: Binance offers leveraged trading of up to 125x on the major coins.

Gemini vs Binance: Supported Cryptocurrencies

Gemini:

Gemini offers a limited selection of cryptocurrencies compared to Binance.

However, it focuses on the more popular and established coins, such as Bitcoin (BTC), Ethereum, and Litecoin, and smaller but popular coins with large volumes like $PEPE.

Binance:

Binance exchange offers a wider range of cryptocurrencies, including many altcoins and lesser-known tokens like Ethereum (ETH), Cardano, BNB tokens, and Solana (SOL).

It also has its stablecoin called BUSD.

Binance’s wide selection of cryptocurrencies gives you the flexibility to diversify your portfolio and explore different trading opportunities.

However, it’s essential to note that trading lesser-known tokens can also come with even greater risks because they do not have high volume.

Gemini vs Binance: Fees for Trading & Deposit/Withdrawal Compared

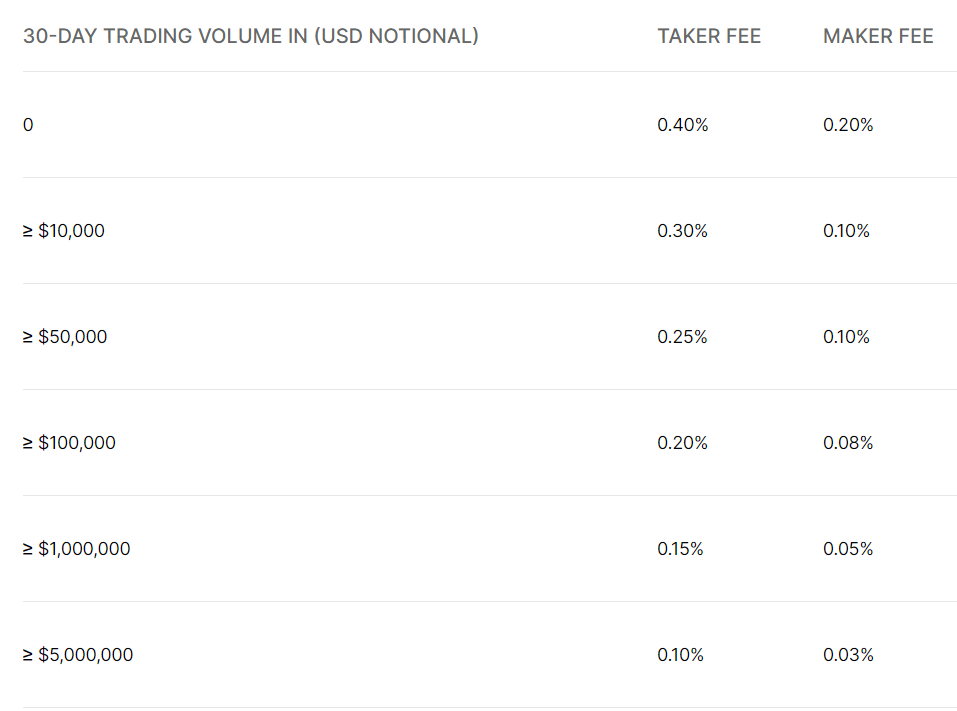

Gemini:

Gemini charges fees based on a maker-taker fee structure, which is worth noting.

It has fees ranging from 0.2% to 0% for makers and 0.40 percent to 0.03 percent for market takers, depending on your trading volume.

While these terms of trading fees are higher compared to some other exchanges, they are straightforward and easy to understand.

Good news!

Gemini does not charge any deposit fees, regardless of the method you use.

Gemini offers a certain number of free withdrawals per month, depending on the cryptocurrency, as these transactions need to be made on the blockchain.

After exceeding this limit, you’ll incur a fee based on the specific coin you’re withdrawing.

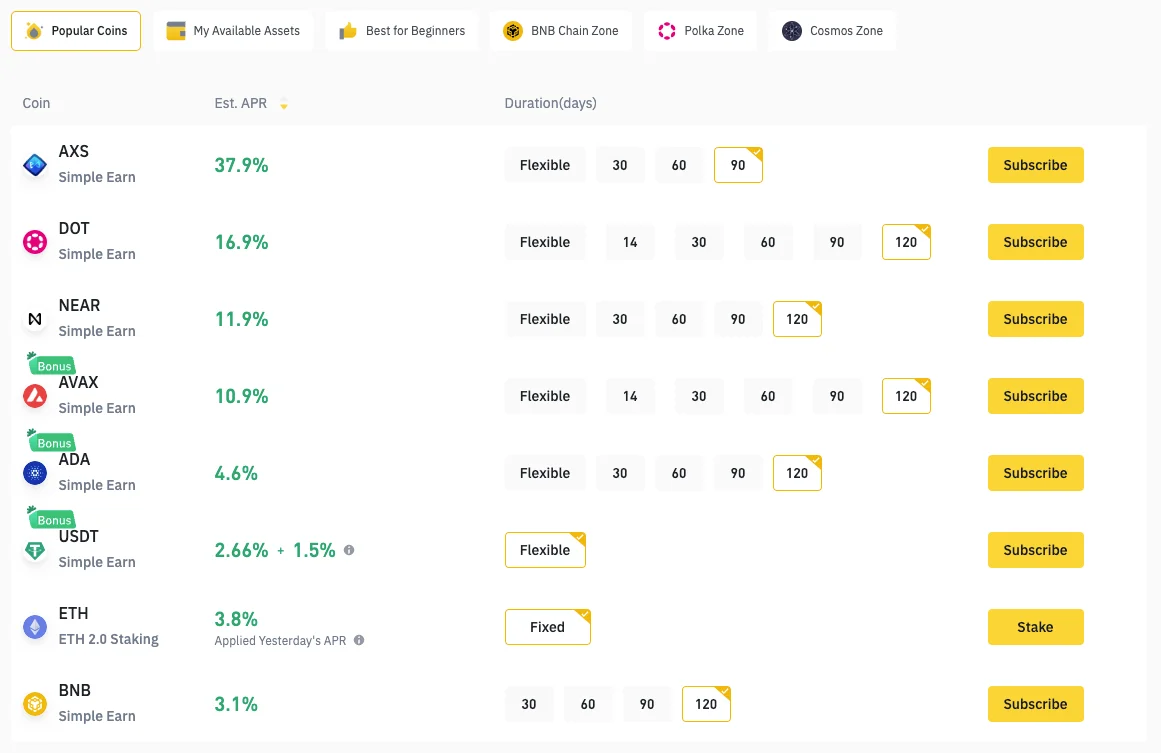

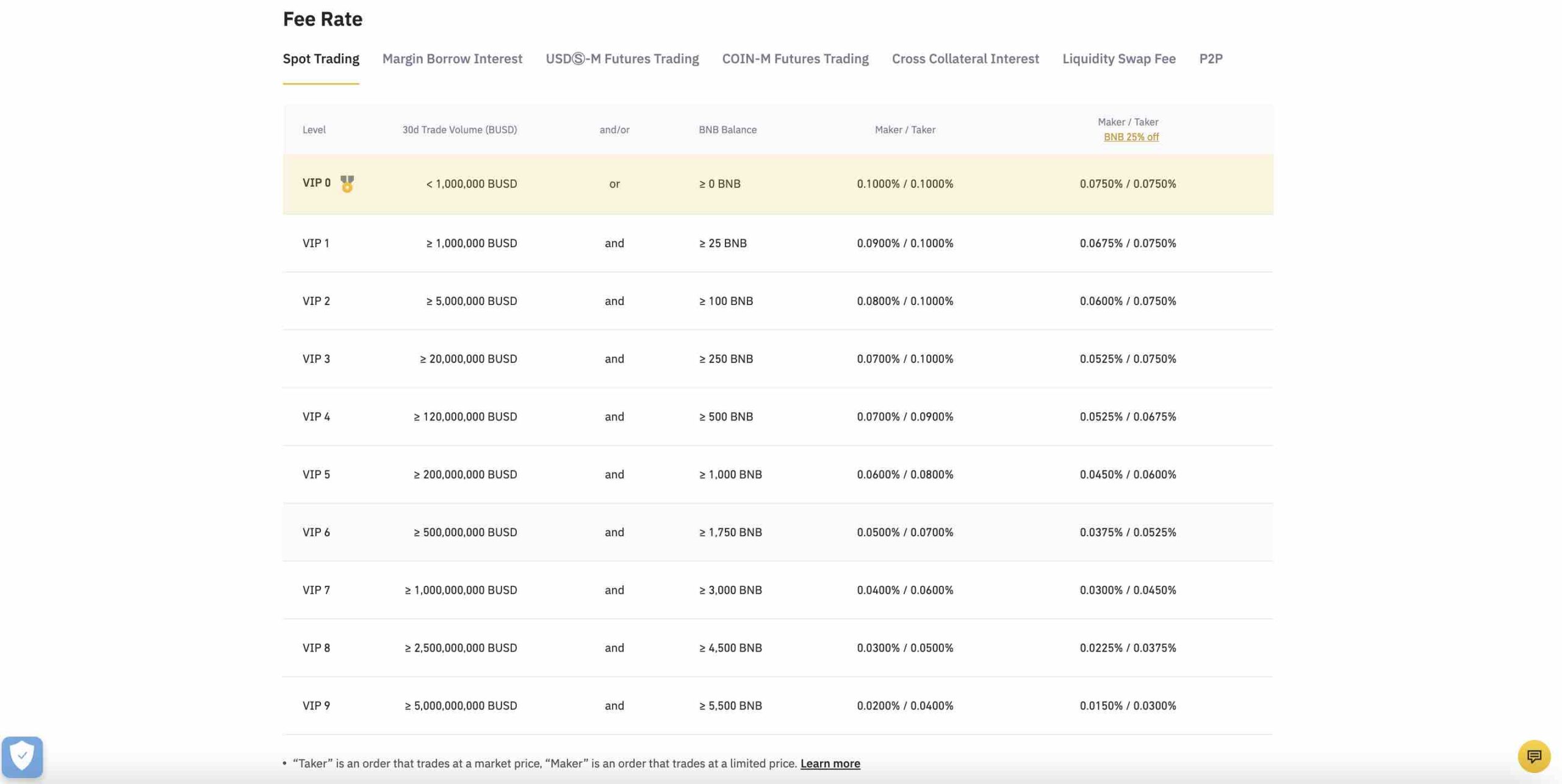

Binance:

Binance also uses a maker-taker fee model, with fees ranging from 0.1 percent for spot trading and 0.02%/0.04% for Futures trading, depending on your trading volume.

These fees are lower than Gemini’s, making Binance a more cost-effective option for frequent traders.

Just like Gemini, Binance does not charge any fees for deposits.

Binance charges withdrawal fees based on the cryptocurrency you’re withdrawing.

Binance offers fee discounts for users who hold Binance Coin ($BNB) and use it to pay trading fees.

The spot trading fees are reduced to 0.075% for both makers and takers and 0.0108%/0.027% for Futures trading.

This can significantly reduce your trading costs if you’re a regular Binance user.

Gemini vs. Binance: Order Types

Following are the order types offered by Gemini and Binance:

Gemini:

- Market Orders

- Limit Orders

- Stop Orders

Binance:

- Market Orders

- Limit Orders

- Stop-Limit Orders

- OCO (One Cancels the Other) Orders

- Trailing Stop Orders

Gemini vs. Binance: KYC Requirements & KYC Limits

When it comes to KYC (Know Your Customer) requirements and limits, both Gemini and Binance have their own policies.

Gemini:

Gemini has a strong focus on regulatory compliance, which means it requires all users to complete a comprehensive KYC process.

This involves providing personal information, such as your name, address, and government-issued ID.

Binance:

There is a tiered KYC system available on Binance, allowing users to choose the level of verification that suits their needs.

Basic verification requires minimal personal information, while advanced verification involves providing more detailed information and documents.

Basic verification comes with a lower deposit, withdrawal, and trading limits, while advanced verification allows for higher limits and access to additional features.

Gemini vs Binance: Deposits & Withdrawal Options

Gemini:

Gemini offers several deposit options for fiat currencies via bank transfers (ACH, wire transfer), debit cards, and cryptocurrency transfers.

You can expect to pay up to 3.49 percent as fees when you use your debit card to add funds.

It provides similar withdrawal options, allowing you to transfer funds to your bank or withdraw cryptocurrencies to your external wallet like Metamask.

Binance:

Binance offers a range of deposit options, including bank transfers, credit/debit cards, cryptocurrency transfers, and even third-party payment processors like Simplex and Koinal.

Binance provides various withdrawal options, including bank transfers, cryptocurrency transfers, and third-party payment processors.

Binance also owns Trust Wallet, a custody wallet where you can withdraw your funds to, or choose a cold wallet you like.

Expect to pay up to 1.8 percent as fees to withdraw to a VISA or Mastercard.

Binance also offers a P2P (peer-to-peer) trading program allowing you to trade crypto directly with other users.

It is not the best in terms of security, but newbies don’t have to use it.

Gemini vs Binance: Trading & Platform Experience Comparison

Gemini:

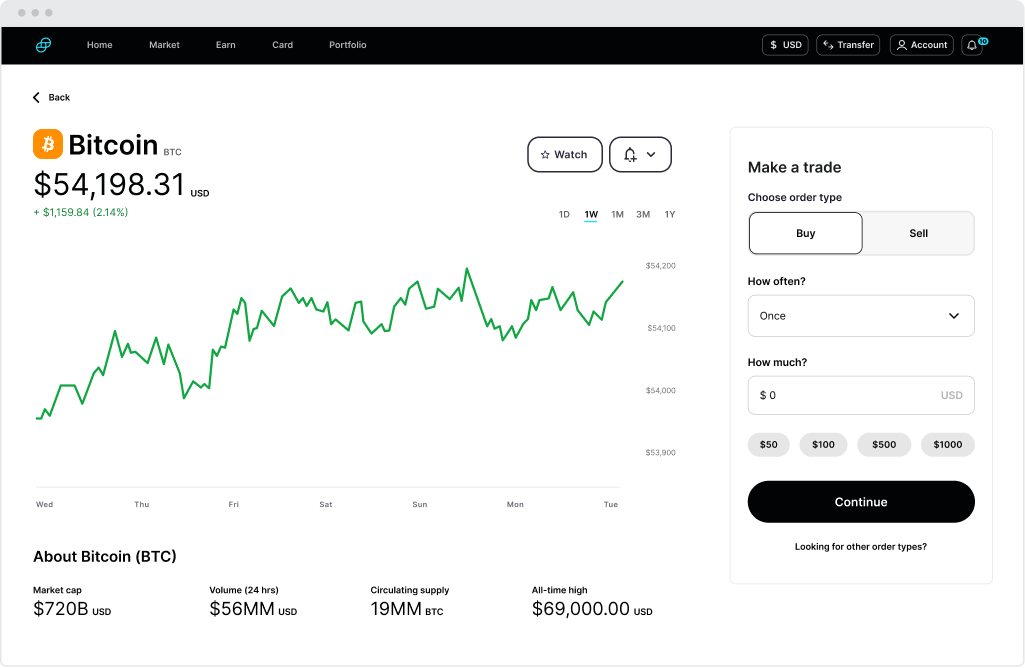

1. User Interface: Gemini’s user interface is clean, intuitive, and easy to navigate. It’s designed with simplicity in mind, making it a great choice for beginners and those who prefer a straightforward trading experience.

2. Trading Experience: Gemini offers a basic set of trading tools and charts suitable for casual traders and those new to the crypto world.

3. Mobile App: Gemini’s mobile app is available for both iOS and Android, offering a seamless trading experience on the go.

Binance:

1. User Interface: Binance’s user interface is feature-rich and caters to beginners and experienced traders. The platform offers a “Basic” view for newcomers and an “Advanced” view for seasoned traders.

2. Trading Experience: Binance offers a wide range of advanced trading tools, charts, and indicators, making it a powerful platform for experienced traders. The platform also provides features like Futures, margin trading, and staking.

3. Mobile App: Binance’s mobile app is available for iOS and Android, offering a comprehensive and informational trading experience on the go.

To know more about the exchange, you can check this guide on How to trade margin on binance.

Gemini vs. Binance: Customer Support

Regarding customer support, both Gemini and Binance offer various channels to assist their users.

Gemini:

Gemini offers multiple support channels, including email, social media, and a comprehensive help center.

Gemini is known for its responsive and helpful customer support and is constantly trying to improve in this regard.

The platform typically responds to email inquiries within a few hours, making it easy to get the assistance you need.

Gemini’s support team is knowledgeable and professional, providing clear and concise answers to your questions.

The platform’s help center also offers detailed guides and FAQs, making it easy to find the information you need.

Binance:

Binance offers various support channels, including live chat, email, social media, and a comprehensive help center.

Binance’s customer support can be slower than Gemini’s, especially during high-volume times.

Live chat and email inquiries may take longer to receive a response, so it’s essential to be patient.

Binance’s support team is knowledgeable and professional, but the quality of support may vary depending on the channel you use.

The platform’s help center provides detailed guides and FAQs, making it easy to find the information you need.

Binance has a large, active community of users who often help each other with questions and issues.

This can be a valuable resource for getting quick assistance or sharing experiences with other traders.

Gemini vs. Binance: Security Features

Gemini:

Gemini uses offline cold storage for most cryptocurrency holdings, ensuring your funds are safe from online threats.

Gemini requires all users to enable 2FA (two-factor authentication), adding security to your account.

This helps stop unauthorized access, even if your password is leaked.

Gemini is available in the U.S. under strict regulations. And adheres to strict compliance standards.

This includes regular audits and transparent reporting, giving you peace of mind that the platform operates within the law.

Gemini’s digital assets are insured against loss due to hacks, insider theft, or other security breaches.

Binance:

Like Gemini, Binance requires all users to enable 2FA, adding extra security to your account.

Binance offers a withdrawal whitelist feature, allowing you to specify the addresses to which you can withdraw funds.

Binance also uses offline cold storage for a significant portion of its cryptocurrency holdings, ensuring your funds are safe from online threats.

It’s essential to note that Binance has faced security breaches in the past.

However, the platform has taken steps to improve its measures and compensate affected users.

Is Gemini Safe & Legal To Use?

The cryptocurrency exchange is registered as a New York trust company and is subject to the oversight of the New York State Department of Financial Services (NYSDFS).

The platform uses offline cold storage for most cryptocurrency holdings like Bitcoin, and Gemini’s digital assets are insured against loss due to hacks, insider theft, or other security breaches.

This provides protection for your funds and gives you peace of mind that your assets are safe.

The platform undergoes regular audits and publishes transparent reports, giving you confidence that it operates with integrity.

Gemini has received positive reviews from many users, praising its security features, regulatory compliance, and user-friendly interface.

Is Binance Safe & Legal To Use?

The platform complies with local regulations in the countries where it operates.

It’s essential to note that Binance’s regulatory compliance may differ depending on your location.

The platform uses offline cold storage for a significant portion of its cryptocurrency holdings, ensuring that your funds are safe from online threats.

Although it has faced security breaches in the past, it is one of the big three exchanges that have withstood the test of time and are still going strong in 2023.

While these incidents may raise concerns, Binance’s commitment to addressing security issues and protecting its users is a positive sign.

The platform undergoes regular audits and publishes transparent reports, giving you confidence that it operates with integrity.

Binance has received positive reviews from many users, praising its wide range of cryptocurrencies, advanced trading features, and responsive customer support.

Gemini vs. Binance Conclusion

In conclusion, both Gemini and Binance cater to different types of traders with their unique features and offerings.

If you’re a beginner or prefer a simple, secure, and highly regulated trading experience, Gemini is the ideal choice.

On the other hand, if you’re an experienced trader looking for a wide range of cryptocurrencies, advanced trading options, and more flexibility in terms of KYC and deposit/withdrawal methods, then consider creating a Binance account.

Whichever you choose, ensure you’re comfortable with the platform’s security measures and regulatory compliance.

Happy trading!

Learn how does Gemini & Binance stack up against the competition:

- Gemini vs Bybit

- Gemini vs Phemex

- Gemini vs Kraken

- Binance vs StormGain

- Binance vs Bitfinex

- Binance vs Gate.io