BTCEX vs Binance – which cryptocurrency exchange should you choose?

The question can be pretty confusing, as both of them are quite similar in many cases.

But still, there are a lot of differences that both these exchanges have.

Hence to help you out, I have compared both BTCEX and Binance head-to-head on different factors. So you can get a clear idea about which exchange would be suitable for your needs.

So here we go:

BTCEX vs Binance: At A Glance Comparison

BTCEX is one of the fastest-growing cryptocurrency exchanges available out there. Even it is a pretty player compared to other names as the exchange was launched back in 2021 only.

The exchange allows you to trade in the spot and perpetual markets with one of the lowest trading fees in the industry. As well as you are getting access to other features like copy trading.

Binance, on the other side, is known as the largest cryptocurrency exchange for day trading by its trading volume. The exchange was established in 2017.

Binance is known as a top global crypto exchange with the lowest trading fees. Plus, it allows you to trade in multiple types of markets, be it spot, futures or margin.

Plus, you are getting access to tons of other crypto features, such as trading bots, swap farming, leveraged tokens, DeFi staking, P2P trading, and more.

BTCEX vs Binance: Trading Markets, Products & Leverage Offered

Let’s start this comparison by looking at the products and trading markets offered by both exchanges:

BTCEX

BTCEX is a newly launched crypto exchange – the features and trading market options are pretty limited. You are getting features like:

- Spot Trading

- Perpetual trading with up to 200x leverage

- Copy Trading

Binance

Binance is a well-established crypto exchange and the largest one out there. Hence, it offers you tons of different crypto markets and other features. Such as:

- Spot Trading

- Spot Margin Trading with leverage between 5x to 10x

- Derivatives trading in USDT, USDC & Crypto with leverage between 1x to 125x leverage

- Crypto Options

- Binance Leveraged Tokens

- P2P Trading

Verdict: Binance emerges as the better choice in terms of supported trading markets. As you can trade in markets like margin and options, which isn’t possible with BTCEX. But BTCEX offers you up to 200x leverage.

BTCEX vs Binance: Supported Cryptocurrencies

BTCEX

BTCEX supports a good number of tokens. There are more than 190+ coins are listed on the exchange, along with 200+ crypto trading pairs.

On the exchange, you would find both popular and unique crypto tokens. Some of the listed tokens are:

- BTC

- RNDR

- EDU

- XPR

- MATIC

- LTC

- ETH

Binance

Binance also supports a good number of tokens. On the exchange, you will find 500+ crypto tokens.

Also, being the largest crypto exchange, it is the favourite choice of many crypto projects to get launched. So you would often find new coins being listed on Binance. Some of the listed tokens are:

- BNB

- ADA

- USDT

- DOGE

- TRX

- BUSD

- DOT

Verdict: Binance once again wins the race by offering an extended number of crypto tokens. However, be assured that you will find all the majorly traded tokens on both exchanges.

BTCEX vs Binance: Trading Fee & Deposit/Withdrawal Fee Compared

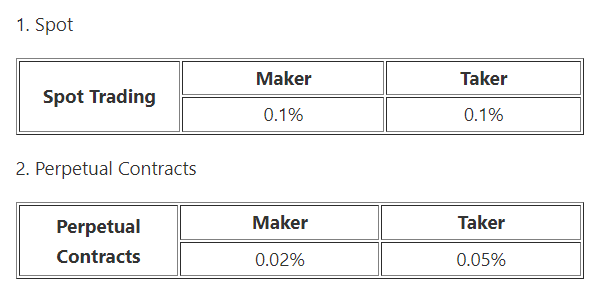

BTCEX Spot Trading Fees

Talking about BTCEX’s spot trading fees, it charges you a flat maker and taker fee. There are no fee structures available on the exchanges. Nor the exchange provides you with any additional discounts for holding certain crypto tokens. Instead, it charges you a trading fee of:

- Maker Fee: 0.1%

- Taker Fee: 0.1%

BTCEX Perpetual Trading Fees

Just like spot trading, BTCEX follows the same thing for perpetual contract trading fees. It charges you a flat trading fee of:

- Maker Fees: 0.02%

- Taker Fees: 0.05%

BTCEX Deposits & Withdrawal Fees

Crypto deposits are absolutely free on the exchange. But you are required to pay withdrawal fees.

Also, withdrawal fees are determined by the blockchain network, and they can fluctuate from time to time. Plus, the exchange charges you a different withdrawal fee for different tokens.

Talking about fiat deposits/withdrawals, if you are buying crypto using a credit/debit card or other payment methods like SEPA, it will attract a transaction fee.

Also, BTCEX doesn’t offer you P2P trading. So there are no free fiat deposits or withdrawals on the exchange.

Binance Spot Trading Fee

Binance Futures is a much better choice in terms of trading fees. As it follows a tiered taker and maker fee structure. So depending on your trading volume, you can avail heavy discounts.

Along with that, the exchange also offers you up to a 25% discount on your spot trading fees when you pay the fee using BNB (Binance’s own crypto token).

So the regular and discount fee stands at:

| Regular Fee | 25% Discounted Fee | |

| Maker Fee | 0.1000% | 0.0750% |

| Taker Fee | 0.1000% | 0.0750% |

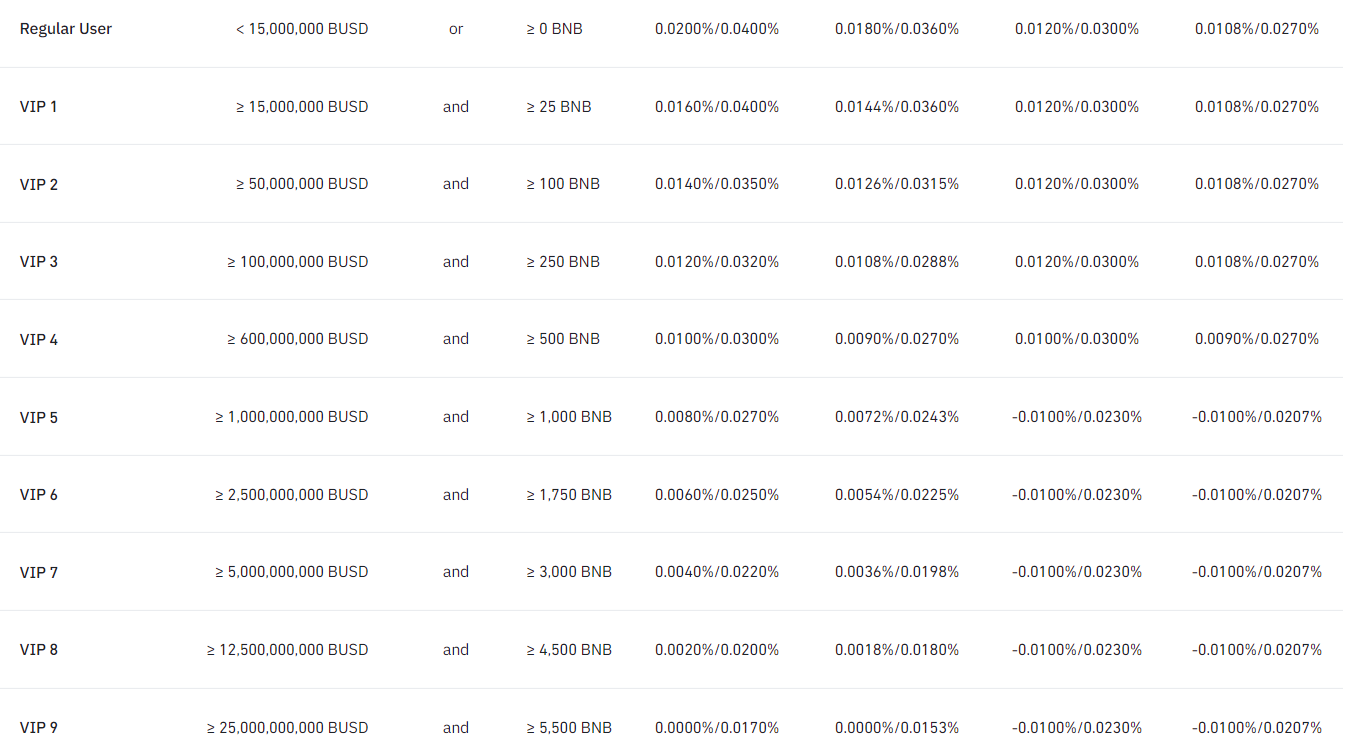

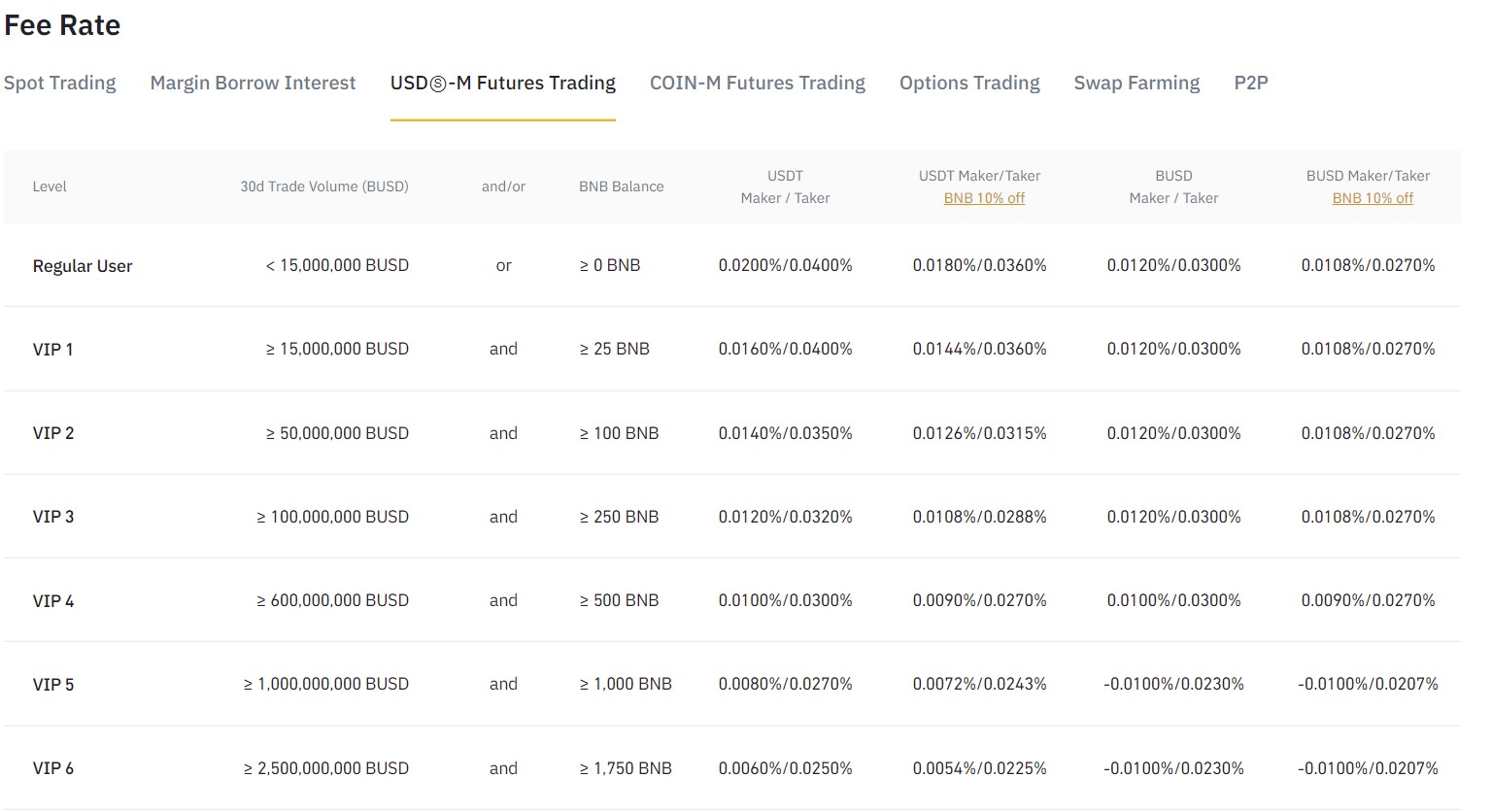

Binance Futures Trading Fee

Binance offers you a 10% additional discount on USDT and BUSD contracts. And here is what the fee structure looks like:

| USD-M Futures Fee | Regular Fee | 10% Discounted Fee |

| Maker Fee | 0.0180% | 0.0108% |

| Taker Fee | 0.0360% | 0.0270% |

| BUSD Futures Fee | Regular Fee | 10% Discounted Fee |

| Maker Fee | 0.0120% | 0.0108% |

| Taker Fee | 0.0300% | 0.0270% |

| Coin-M Futures Fee | Regular Fee | |

| Maker Fee | 0.0100% | |

| Taker Fee | 0.0500% | |

| Binance Options Trading Fee | Regular Fee | |

| Maker Fee | 0.020% | |

| Taker Fee | 0.020% |

Binance Deposit & Withdrawal Fees

Crypto deposits on Binance are also free. But for crypto withdrawals, you are required to pay fees. The fee varies from one cryptocurrency to another and depends on various other factors.

Coming to fiat deposits or withdrawals, the fee depends on what payment option you are using. For certain options, there is no fee, but for some payment options, you are required to pay fees.

But fortunately, on Binance, you have a P2P trading option. So you can avail of free deposit and withdrawal of funds.

Verdict: Binance is the clear winner. The exchange not only has cheaper trading fees compared to BTCEX. But it also offers you heavy discounts on both Spot and futures trading.

BTCEX vs Binance: Order Types

BTCEX

- Limit

- Market

- Conditional

- Trailing

Binance

- Limit

- Market

- Stop Limit

- Stop Market

- Trailing Stop

- Post Only

- TWAP

Verdict: With Binance, you are getting a few extra order types. Hence, it is the winner for this section.

BTCEX vs Binance: KYC Requirements & KYC Limits

BTCEX

BTCEX is a no-KYC exchange to an extent. The exchange doesn’t require you to complete identity verification. With just your email verification, you will get unrestricted access to deposit, withdrawal, and trading.

However, your daily withdrawal limit would be capped at 30,000 USD. But you can always enhance your limits by verifying your account.

It has one extra KYC level that is applicable to both individuals and enterprises. And with this, you will get zero restrictions on deposit, withdrawal, trading, and fiat-top-up and a daily USDT withdrawal limit of 250,000.

Binance

Binance has made it mandatory to complete KYC. Without verifying your account, you won’t be able to access any of Binance’s features. Also, Binance has different levels of KYC with different deposit and withdrawal limits.

KYC Limits

Binance has three different KYC levels, these are:

- Verified: A daily fiat Limit of 50K USD Daily.

- Verified Plus: A daily fiat Limit of 2M USD Daily.

- Verified Plus (2): Unlimited Fiat Transactions.

Verdict: BTCEX is the clear winner. Since you can use the exchange without completing your KYC.

BTCEX vs Binance: Deposits & Withdrawal Options

BTCEX

- Method 1: Deposit/withdraw fiat using payment options like SEPA or credit/debit card purchases.

- Method 2: Deposit/withdraw crypto tokens using another crypto wallet or exchange.

Binance

- Method 1: Deposit/withdraw fiat using payment options like Simplex or Banxa (Credit/Debit card & Bank Transfer supported).

- Method 2: Use Binance’s P2P trading to deposit/withdraw your local currency using your local payment methods.

- Method 3: Deposit/withdraw crypto tokens using another crypto wallet or exchange.

Verdict: As Binance offers you a more convenient way to deposit/withdraw funds, it is the winner for this segment.

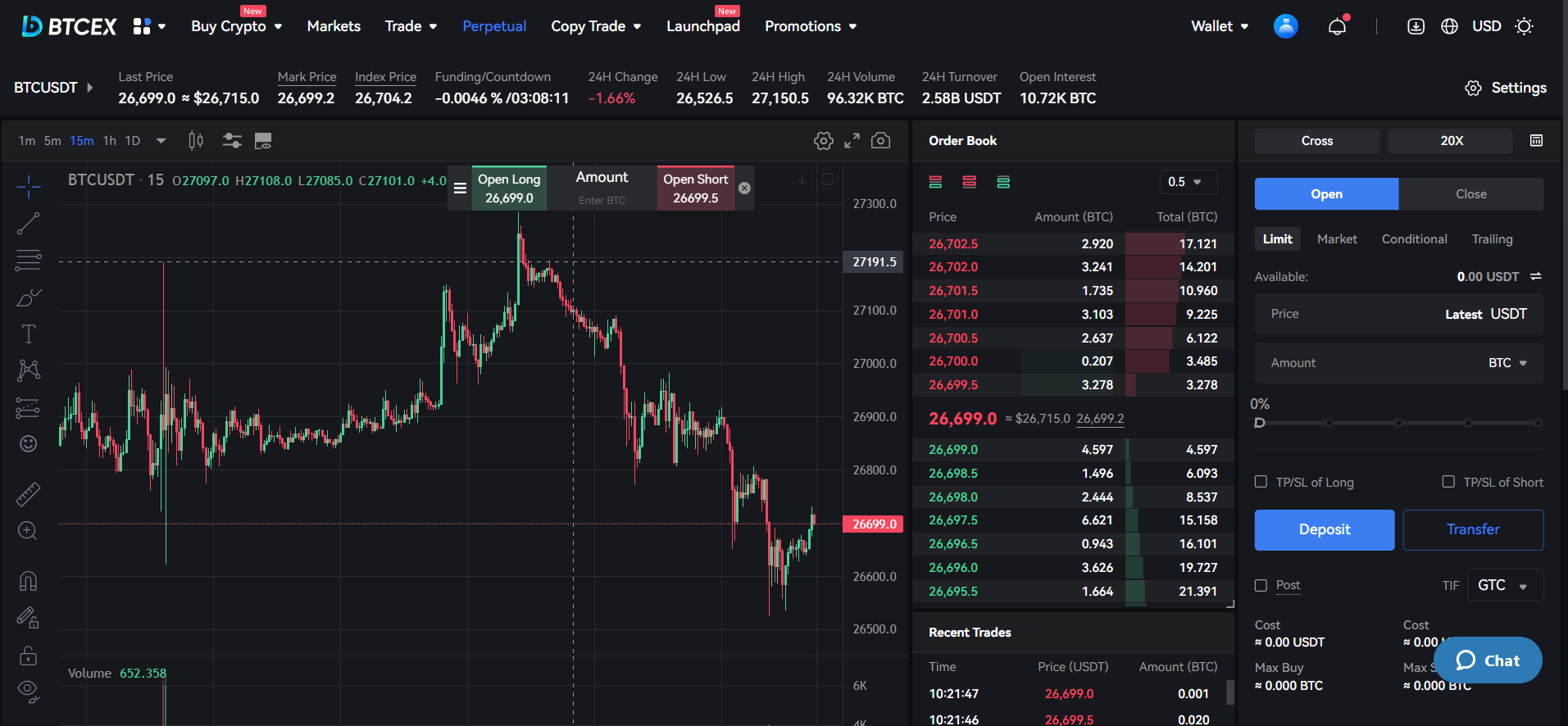

BTCEX vs Binance: Trading & Platform Experience Comparison

BTCEX

- Technical chart powered by TradingView

- Trading pair details

- Easy-to-use order form

- Order book

- Recent trades

- Multiple trading pairs

- Positions, open order, order history & trade history

- Mobile app

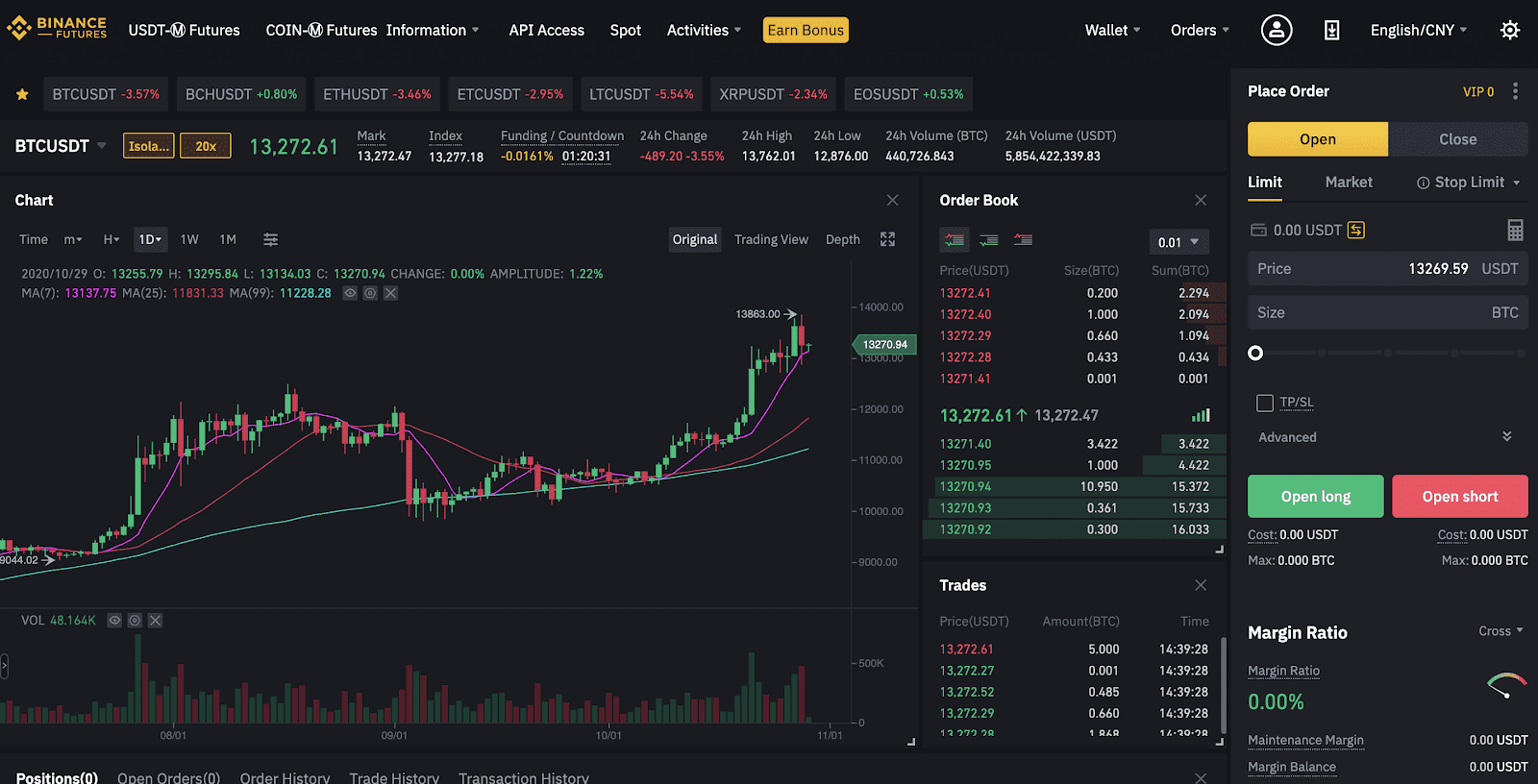

Binance

- Multiple technical charts, including TradingView

- Easy-to-use order form

- Trading pair details

- Order book

- Recent trades

- Positions closed P&L,

- Current orders, order history, and trade history

- Mobile app

To learn how to trade on the exchange, you can check this guide on how to short ethereum on Binance.

Verdict: There are hardly any differences in terms of overall trading experience and the platform. You would find both platforms to be pretty identical and have the same features. Hence, it is a tie between BTCEX and Binance.

BTCEX vs Binance: Customer Support

BTCEX

BTCEX customer support can be reached in multiple ways. The usual option is to opt for the live chat option. Alternatively, you can also reach out to them by raising a support ticket. The best part about BTCEX is that it offers you customer support in multiple languages.

Binance

Binance support can be opted for in a similar way. The exchange also has a live chat option that allows you to contact them via email. Plus, you can also reach out to them on Twitter, and the exchange has a quicker response time. Also, Binance offers its customer support in 8 different languages.

Verdict: Both exchanges stand in an equal position when it comes to offering support. Hence it is a tie between Binance and BTCEX.

BTCEX vs Binance: Security Features

BTCEX

- Two-factor authentication

- Whitelist address

- Bind your phone number

- Anti-phishing code

Binance

- Two-factor Authentication

- Passkeys and biometrics

- Real-time monitoring

- Advanced-data encryption

- One-stop withdrawal

- Withdrawal whitelist

- Anti-phishing code

- Device management

Verdict: Binance undoubtedly is the clear winner and a better choice. As it offers you more security features compared to BTCEX.

Is BTCEX Safe & Legal To Use?

BTCEX is a safe and legitimate cryptocurrency exchange.

The exchange is designed to be secure, easy to use, and known for offering advanced trading options.

Along with that, the exchange has also implemented several security features and uses cold storage to protect your account and your funds. Also, the exchange doesn’t have any history of security breaches.

Is Binance Safe & Legal To Use?

Without any doubt, Binance is one of the most secure platforms for crypto trading.

The exchange is widely trusted, and it is registered in Malta and follows all the rules and regulations there.

The exchange also doesn’t have any history of hacks and has several security features in place to help you protect your account.

BTCEX vs Binance: Why not use both?

In the end, it is Binance that clearly wins this comparison.

The exchange has more market offerings, lower trading fees, better customer support, and more. Also, it is the largest crypto exchange that offers you deep liquidity. So go ahead and open a Binance account to trade effectively.

But BTCEX cannot be ignored as well. The exchange has leverage up to 200x, cheaper trading fees, and a great trading platform.

So go ahead and check both these exchanges out and see which one works for you.

Learn how does BTCEX & Binance stack up against the competition:

- Binance vs Bybit

- Binance vs OKX

- Binance vs Huobi

- Binance vs MEXC

- Binance vs Deribit

- Binance vs Gemini

- Is Bitcoin Real Money?: Understanding Different Types Of Money - June 28, 2024

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023